Strong triggers for Strides Shasun

Settlement with Mylan and strong forecast for the second half of FY17 are positives

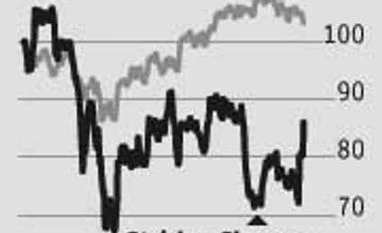

Ram Prasad Sahu Mumbai The stock of Strides Shasun gained 7.2 per cent on Thursday, after it announced that Mylan agreed to settle regulatory and general claims over Agila transaction.

Strong forecast for the second half of FY17, product approvals and listing of its biopharmaceutical unit, Stelis Biopharma, also helped the stock gain 20 per cent in a week.

The company had earlier approved the demerger of the biopharma business and listing of this unit. Strides is expected to own 20 per cent stake, while Jordan-based investment company GMS Holdings will control 25.1 per cent, the rest being with the shareholders of Strides.

GMS had entered into an agreement with Strides in 2014 whereby its Singapore-based arm would invest $21.90 million for a 25.1 per cent stake in the company. The first tranche of this investment ($8.49 million) was made in February.

The company also announced that it received approval from US FDA (Food and Drug Administration) for HIV drug Abacavir. The market size for the drug, according to IMS, is about $30 million. The approvals and launches by the company are part of its strategy to increase R&D, with a plan to file 10-12 new abbreviated new drug applications (ANDAs) in the second half of the current financial year, largely in the complex and niche generic space.

There are 25 ANDAs pending approval with the USFDA. The company, which received five approvals from the regulator in the first half, expects a similar number of approvals in the second half, and this includes a key drug Lovaza. The cardiovascular drug generates about 13 million pounds of sales per quarter for GSK Pharma.

The Street is excited about the strong Ebitda forecast of Rs 440- 470 crore in H2. Given the low profitability in the June quarter, there were concerns about the company’s ability to successfully integrate the nine acquisitions it had carried out over the past one- and-a-half years. Analysts at IDFC Securities say good recovery across multiple segments in the September quarter and strong profitability forecast for the second half of FY17 significantly mitigate these concerns. They are positive on the medium-term earnings possibilities of the company’s diversified business model and its value creating potential.

At the current price, the stock is trading at 28 times its FY17 earnings. Given the sharp run-up, investors will need better entry points, and at least a couple of years of investing horizon to make money.

)

)