Foreign portfolio investors (FPI) have turned wary about emerging markets after the Federal Reserve signalled that it was going to lighten its balance sheet and, quite possibly, raise USD policy rates again by December. Every emerging market saw corrections in the second half of September. India was among the worst hit, as FPIs rebalanced to safer hard currency assets.

FPIs sold over Rs 11,000 crore of equity in September and they’ve substantially cut back on rupee debt buying, too. Domestic institutions bought in huge quantities. But the market fell since retail investors also sold in large quantities.

There are storm clouds looming now over the Indian economy. Global crude prices have climbed in the wake of the hurricanes, which knocked out US capacity. This is probably transient, but it has political implications as the price hikes are being passed directly onto consumers without any mitigation of taxes on fuel. It will have some impact on the trade balance and inflation expectations.

India’s gross domestic product (GDP) growth is being re-rated down by near-unanimous consensus. The macroeconomic balance sheet looks shaky. The fiscal deficit has hit 96 per cent of the full fiscal target; the current account deficit is up a lot. The monsoon has been so-so — food production may be lower than last year, affecting rural consumption.

We won’t really know how the goods and services tax (GST) collection is working, for a while. So it’s hard to make a call on the fiscal deficit. But the GST has obviously caused a large disconnect between formal and informal sectors and brought unexpected pain to bear upon services. Manufacturing may eventually gain from the integration of the national market. But services, which operated in an integrated national market anyhow, is facing a compliance barrier; GST has also effectively caused the services market to disintegrate into multiple regions.

Hence, companies are struggling with teething problems of GST compliance. Many face working capital crunches as well, due to the slow tax credit offsets. Exporters, in particular, are under stress. Quite a few companies have external commercial borrowings due for servicing in mid-October. A lower rupee could cause more pain for them.

The Larsen & Toubro senior management is now on record saying the disruption will last for a substantial period and there is no sign of revival of private investment. This gels with the earlier gloomy prognoses from the State Bank of India. As SBI and L&T are among the largest of concerns in their respective sectors, these projections must be taken seriously.

Results season is around the corner. Corporate results for July-September aren’t expected to be very exciting due to the impact of the GST. Of course, the market will be seeking clues about future direction and trying to figure which companies have quickly integrated their value chains.

Information technology sector leaders will, as always, be among the first lot to declare results and their guidances could swing the market, given a revival in interest on the back of a weaker rupee. Analysts will also be interested in knowing if banks are any closer to tackling the twin balance sheet problem. The new bankruptcy law may help, but it has had unexpected consequences, too. Ericsson filing an insolvency petition against Reliance Communications could set off a new trend where vendors target tardy customers using the law. There’s anecdotal evidence that this may be happening with threats leading to quicker out-of-court settlements of outstanding payments.

Retail investors usually take a break from trading during the Durga Puja-Diwali period. But there are also hopes of consumption picking up during the festive season. Making seasonal adjustments will be tricky. Durga Puja (North Indians call this period Navratri- Dussehra) is usually in October. Diwali sometimes falls in October, sometimes November. Last year, both festivals were in October, leading to low industrial activity that month. The September 2017 Index of Industrial Production (IIP) may be depressed compared to September 2016, due to the extra holidays. But October 2017 IIP may see a sharp rebound versus that of October 2016.

Traders will be hoping against hope that the Monetary Policy Committee (MPC) cuts policy rates this week. It’s unlikely. Inflation has shown an upward spiral. Plus, the rupee is under pressure with a two per cent fall in the last fortnight. So the MPC is likely to maintain status quo.

The market’s future direction, as opposed to the direction of the economy, could be defined by FPI attitude to India and to emerging markets in general. China has seen a sovereign rating downgrade from S&P. The reduced mandate for Angela Merkel in the German elections has been shrugged off and eurozone stocks enjoying one of the best years in recent memory.

There’s also been speculative activity in gold, following a crackdown on bitcoin, other cryptocurrencies and initial coin offerings across several nations. Speculators are also building big USD short positions going by trends in global forex futures.

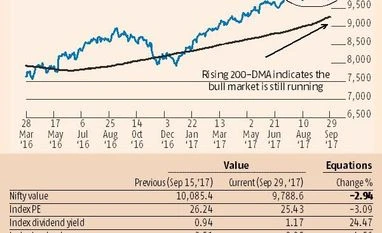

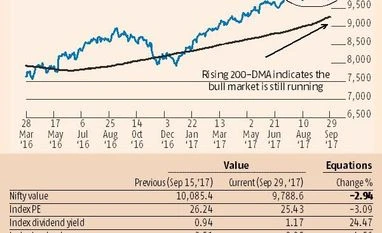

Technically, the Nifty hit new highs at 10,178 during the last 10 sessions. Then it corrected sharply to support between 9,675-9,700. If it falls lower, it would create a bearish pattern of lower lows with a possible short-term target of 9,350. This could happen if the FPI selling continues. But long-term indicators such as the rising 200- Day Moving Average still seem to be bullish.

)

)