Your child has secured admission to a university in the US and is preparing to fly abroad for the spring term. One of the things bothering you is how to send the money. In addition to the tuition fees and other college-related expenses, money is also required for day-to-day expenses. How much money can you send? Is it better to send it through a bank? Will an authorised forex dealer give you better rates? Is a forex card a good option?

Under the Liberalised Remittance Scheme (LRS) of the Reserve Bank of India (RBI), an individual can remit $250,000 aboard per year. This includes money remitted for educational purposes.

“The fees for a two-year postgraduation course at US universities can range from $120,000-130,000 (Rs80-90 lakh) for Ivy League universities to as low as $20,000-25,000 for state universities (Rs14-17 lakh). So, the limit under the LRS is sufficient for most universities,” says Naveen Chopra, chairman, The Chopras, an educational consultancy firm.

Many universities also offer a discount if you pay fees for the entire course together (usually two years in case of a postgraduate degree like a Master of Business Administration). So, use that option if it is available and save some money, Chopra adds. If you need more than the limit under the LRS, that is possible, if you get a letter from the university.

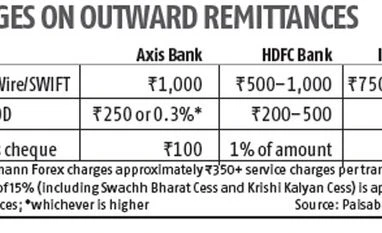

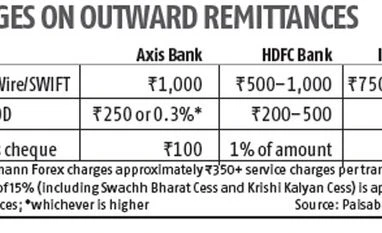

Bank or authorised dealer: Money is remitted through telegraphic transfer or SWIFT transfer. SWIFT is the international payment network used by financial institutions to send and receive money. Only banks and authorised dealers with an AD-II licence can offer remittance services. It is also possible to send money through demand drafts or cheque but that takes time to clear.

You can send money through your bank. All banks have either an overseas branch or an account with another bank known as correspondent bank in the country where the university has its account. In this case, you pay your bank in rupees. The bank then converts it into dollars and credits it to the overseas bank. The overseas bank then sends the money to the the university’s bank. The transaction costs will include charges paid to your bank, as well the intermediary or corresponding bank.

There are several RBI-licenced money changers who also offer remittance facilities that you can consider. “The normal intermediary bank charges vary between $8 and $20 per transaction, depending on the intermediary. One thing to keep in mind is that the intermediary fee is paid upfront before transferring the money. Otherwise, the amount that finally reaches the university may lesser than required. This will cause unnecessary problems to the student,’’ says K Mohan Bhakta, executive director, Weizmann Forex.

Although banks have wider reach, as they have many branches, not all branches will be authorised to offer remittance services. On the other hand, private forex dealers often provide doorstep service and personalised help with documentation and related guidance. “Banks handle huge amounts of remittances. Student remittances are only one of the services they provide. Whereas for players like us, this is our main business and we offer dedicated services for student remittances. Also, banks normally charge a higher margin than us, because their overheads are higher,’’ he says.

For instance, a bank may charge one-three per cent above the interbank rate as margin, while a forex dealer may charge between 0.5 per cent and one per cent above the interbank rate. Private forex dealers also offer rates after speaking to customers and hence they vary. Even the transaction charge can vary, depending on the customer.

Look at charges and conversion rates combined: However, it is not that simple. While remitting funds, you must look at both fees or charges and the exchange rate together, says Adhil Shetty, chief executive of Bankbazaar.com. The fees can either be a flat amount, for instance, Rs300 for transferring $1,000. Or it could be a percentage, for instance, 0.125 per cent of the amount, per transfer.

“One option may offer a low charge but higher exchange rate, while another may offer the opposite. So, calculate before you choose to know how much rupees you will pay and how much dollars you will finally get,’’ Shetty says.

Another factor to consider is the time taken for the Know your customer (KYC) process and how urgently you need the funds. For instance, if you are transferring money from the bank where you have your salary account, you may not need to do the KYC process. But, the bank may take three to four days to give you the money. On the other hand the forex dealer may ask you to do a KYC but give you the funds within 24 hours.

Documents required: These include a valid passport, student visa, university offer letter and PAN card. For KYC, you will require documents to show proof of identity and resident.

Other modes of carrying funds: Funds remitted under the LRS can take care of the bigger expenses like college fees. For the day-to-day expense, students can carry currency, up to $3,000 or a pre-paid forex card loaded with dollars, up to a limit of $7,000, says Shetty.

)

)