Debt mutual funds were a perfect substitute to the conventional fixed deposits (FDs) because they offered much better post-tax returns. But the Budget 2014-15 took away the tax advantage of debt funds. Now, for debt funds to enjoy the benefit of indexation (gains after calculating inflation), they have to be invested in for three years or more. Having said that, liquid funds haven't been badly impacted because even though the tax advantage may have lessened, the convenience and better absolute returns they offer for very short-term, even overnight investing, is significant.

The change in taxation affects investors who have money for one to three years of investment or goals arising within that timeframe the most. If investors invest in FDs, Fixed Maturity Plans (FMPs), or income finds for less than three years, the returns get taxed at their respective marginal tax rate of 10 per cent, 20 per cent or 30 per cent. Most likely, the post-tax return from these FDs, FMPs or income funds will fail to beat current inflation levels.

There are three questions that will arise in the minds of investors:

* Do we have a substitute that could offer improved post-tax returns? How does it work?

* How safe is the substitute from protecting capital perspective?

* How will it better the income funds' returns?

Fortunately, the arbitrage fund could work as a substitute to the debt funds (that is, FMPs/income funds) for a period of more than one year and less than three years.

How does it work? As you know, there are two markets - the spot market and the futures market. There is a price difference between the two. The fund manager buys a stock in the spot market. At the same time, he sells an equal quantity in the futures market. By doing this he doesn't take any market risk.

A fund manager buys, say, 100 shares of Infosys at Rs 3,560 in the spot market. At the same time, he sells an equal quantity in the futures market, at say, Rs 3,585. So the fund manager has booked a Rs 25 gain - on the expiry date of the future, the price converge providing the fund manager the gain of Rs 25.

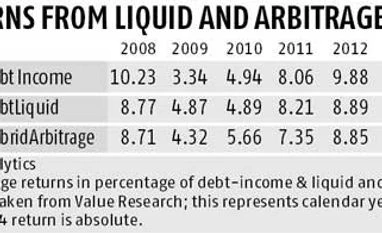

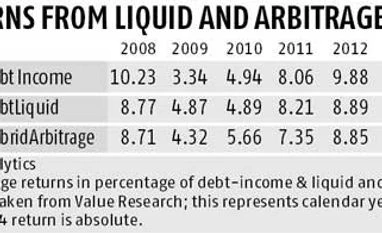

The difference typically reflects the interest rate in the economy, mainly the overnight liquid fund rate. Please note the similarity in liquid and arbitrage fund returns (see table).

When do arbitrage funds work? We need to ask if arbitrage funds are good at capital protection. Most of the time arbitrage funds mimic the liquid fund returns that prevail in the economy, but it may not work as a perfect substitute to liquid funds for three reasons:

* It is volatile over a short-term period

* One month in the last five years has seen a very marginal negative return as well

* On a one-month rolling return basis it has underperformed 19 out of 40 quarter periods over the last 10 years

However, arbitrage funds work as a good substitute for income funds over a one- to three-year time horizon.

Rolling return analysis The three months and above rolling returns of arbitrage funds over a period of five years show that they have never been negative. However, the returns fluctuate quite a bit, with the worst three months rolling return being 0.55 per cent absolute. The rolling returns over one, two and three years gain steadiness with the maximum returns being in the 9 per cent region, whereas the worst return is four to six per cent.

The volatility in returns is a function of the arbitrage spread. It widens during uncertain and volatile times. Hence, it delivers a slightly better return during such times. However, the same typically narrows when the stock market is unidirectional.

Better returns than income funds The worst return of arbitrage funds over two and three-year period equals post-tax FD returns. The upside of this strategy is that it can generate a post-tax return in the range of 9-9.5 per cent per annum. Arbitrage funds qualify as equity investment, resulting in tax-free returns for investments of over one-year periods. So, on the downside, long-term investors have very little to lose, but the upside offers good 9 per cent tax-free returns.

What to watch out for: One has to be careful in selecting arbitrage funds because some of them have higher exposure to the debt category. The equity and equity-related instruments must cross the minimum average of 65 per cent to qualify as equity funds and to get the tax advantage associated with it. The whole purpose of using arbitrage in this situation is tactical. If this point is overlooked, the purpose itself will get defeated.

The author is the founder & CEO of Fincart

)

)