After two years of deficient rains, heavy showers are welcome and required. However, they can damage your vehicle and house. A comprehensive home insurance and some add-on motor insurance covers can help reduce the cost you incur for any monsoon-related damage. And, since there is no waiting for these add on covers, you can buy these even now.

A common monsoon problem is flooding faced by people staying in low-lying areas. If not flooding, excess rainfall can also cause these leakage in the walls and floors, which in turn can damage electrical appliances. These can also get damaged during lightening, says Sasikumar Adidamu, chief technical officer, non-motor Bajaj Allianz General Insurance.

During the monsoons, vehicles are prone to damage due to poor visibility, collapse of trees or buildings, water logging, slippery roads and others. This leads to breakdown, engine problems and even serious multi-vehicle accidents. says Vijay Kumar, president, motor insurance, Bajaj Allianz.

Home insurance A comprehensive householder insurance will take care of damages due to water logging or flooding. It also covers damage to electrical appliances and walls due to flooding. "Usually, after a natural calamity like an earthquake or flood we do get lot of enquires. But conversion into actual sales is very low,'' says Adidamu.

If you stay in a flood-prone zone, you may be charged a higher premium, says Naval Goel, founder, Policyx.com.

To make the claim for damaged appliances, one should present the invoice of the original bill. In case the original invoice is missing, the company usually gives the benefit to the insured and reimburses expenses incurred on repairing the appliances.

For property damage claims, a brief on the situation of loss and the estimated cost of repairs is required to lodge the claim, says Puneet Sahni, head of Product Development, SBI general insurance.

If a property is undervalued, say at Rs 80 lakh when the actual price is Rs 1 crore, it is possible the claim may not be paid, says Yashish Dahiya, Chief Executive Officer(CEO) and founder Policybazaar.com.

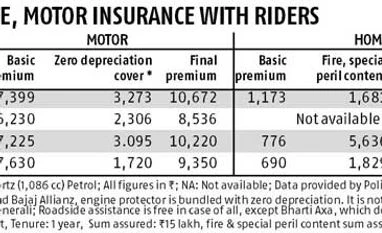

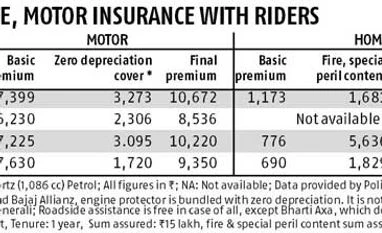

Motor insurance "A standard motor insurance policy would cover cleaning charges if the vehicle is submerged in water. It also covers accidental damages to the vehicle. However, it does not cover damage to the engine due to water seepage (hydrostatic lock). It also does not take into consideration the depreciation amount on the repair and replacement of parts while determining the claim amount payable,'' says Kumar.

But there are add-on covers for these damages.

Depreciation shield or zero depreciation cover: A zero depreciation cover will pay for the major expenses you might have to incur for replacing your vehicle's damaged parts. Otherwise, you could end up paying as much as 50 per cent of your vehicle's value for replacing the damaged components.

The cost depends on the age of the vehicle, model and which segment it belongs to. For a newer or lower segment vehicle, the premium would be lower. A zero depreciation cover can increase your total annual by Rs 700-1,600. "This cover is usually not available for vehicles more than five years old or in, some cases seven years old," says Dahiya.

Engine protector: It covers any damage to the vehicle due to inundation or seepage of water into the engine.

"It also covers damage to the undercarriage of the engine, if you drive your vehicle after it has developed a snag. For instance, if you drive the car despite the gear box getting damaged or an oil leak, again common problems in monsoon," says Sahni.

It is useful especially if you have a four-wheeler withlow ground clearance, as chances of water entering the engine during monsoon are higher.

The price depends on the vehicle age and city of registration and range from 0.2 to 0.3 per cent of the value of the vehicle. It can be between Rs 600 and Rs 1,000.

24x7 spot assistance or roadside assistance: This cover offers round-the-clock roadside assistance and benefits, from a flat tyre and towing assistance to even medical coordination and legal help. Many companies offer roadside assistance as part of their base policy. It costs Rs 150-500.

There could be a restriction on the number of claims you can make in a policy year. For instance, in the case of zero depreciation cover, some companies allow only two claims, while in case of roadside assistance, some allow up to six claims.

)

)