It's not often that a property purchase is funded through a gold loan. Yet, that's exactly what the client of a South-based financial planner recently did to purchase his property worth Rs 50 lakh. The own-contribution requirement was Rs 10 lakh. The client had funds worth Rs 6 lakh and met the shortfall of Rs 4 lakh through a gold loan. Once the property was purchased, the client repaid the gold loan with a top-up loan for home improvement - all in four months.

This shows one's assets - gold, property, shares, fixed deposits and even insurance - if leveraged intelligently can serve to meet your immediate or long-term funding needs. For instance, loans against gold are ideal for immediate, short-term needs; those against property are effective for a duration of more than five years.

What's more, these can be a lot cheaper than personal loans. In fact, at present, loans against fixed deposits (FDs) can even work out to be cheaper than home loans. "Since you are providing a collateral, the chances of your loan request getting rejected are virtually nil, even if your credit rating is poor," says Suresh Sadagopan, a certified financial planner.

Banks usually charge lower interest rates than non-banking financial companies (NBFCs) on these loans. "Competition is fierce and borrowers should compare rates offered by both banks and NBFCs before zeroing in on a loan," says Adhil Shetty, chief executive officer (CEO), BankBazaar.com.

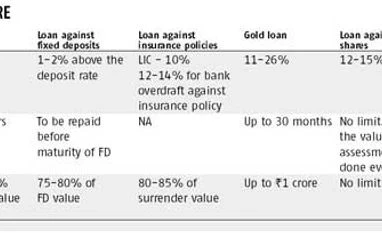

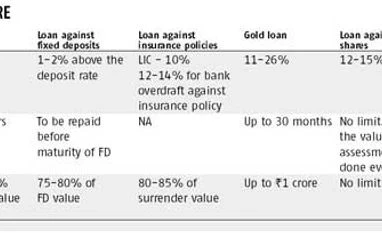

Loan against gold These are short-term, taken for one to two years. Interest rates are typically 12-14 per cent but vary depending on the reputation of the lending institution, absolute amount, loan to value (LTV) ratio and the category of borrower. Banks give these for six months but it can be rolled over for two to three years every six months.

What's good: One can typically get loans for 70-75 per cent of the total value of the pledged gold. "NBFCs are more popular than banks in this category, as the loans are processed faster and documentation involved is low. This is despite the fact that they may charge one or two per cent higher interest than banks," says Sadagopan.

What's not: If gold prices decline, your LTV ratio goes up and the borrower has to fill the gap with his own money. If the gap is more than 10 per cent, the bank will liquidate gold to recover the money. "Keep an eye on the LTV ratio and gold prices. The worst thing that can happen is a bank selling your gold when the prices are down," says Shetty. According to Divakar Vijayasarathy, CEO of MeetUrPro, one should approach only reputed institutions for such loans, as safety of the gold can be a concern. "If jewellery is pledged, the loan value will exclude stone, wastage and making charges," he says.

Suitability: Ideal for those with idle gold in bank lockers who want money at a moment's notice.

Loan against shares These are taken for one to three years, with interest rates at least 25 basis points higher than gold loans. Banks typically give you loans of up to 50 per cent of the LTV ratio.

What's good: These loans are given speedy approval, particularly if the borrower has a savings account with the same bank. "There is not much documentation involved and one can get the loan sanctioned the same day. You will have to give a valuation certificate for the shares as per the current market price," says Hiren Dhakan, associate fund and wealth manager, Bonanza Portfolio.

What's not: You will not be able to sell the shares and cut your losses in the event of a market crash. Also, banks have to maintain a certain LTV ratio and if the shares fall in value, the borrower might have to pay more money to make up the deficit. "Banks can sell your shares to make this up," says Shetty.

Suitability: Those who need money for an emergency and are confident of repaying the loan in 15 days to three months can go for such loans. It is better than a personal loan as there are no prepayment charges but not as good as a gold loan, as the interest rates are higher. "This is a better option than selling shares to meet your funding requirement. Once you sell your shares, it might be difficult to buy it back," says Shetty.

Loan against property

This can only be taken against your own house, provided it is not under a loan. The tenure for such loans is seven to 10 years. Interest rates are higher than regular home loans, minus the tax benefits for the latter.

What's good: The amount of paperwork and documents required are almost similar to a regular home loan but the processing time is faster.

What's not: Prepayment charges apply and could be as high as three to five per cent of the principal amount due for the first year, says Dhakan. Loans are given for up to 60 per cent of property value but banks also consider a person's capability to service it. "It is entirely possible that you pledge a Rs 5-crore property but get a loan for Rs 30 lakh instead of Rs 3 crore. Banks typically examine the borrower's income, existing loans, etc, to assess whether the loan can be serviced and closed on time," says Sadagopan.

Suitability: "I would not advise people to go for such loans, except when they want to undertake structural changes to their property, including furnishing and repairs. This is because prepayment charges are high, interest rates are not considerably lower than personal loans and there's no tax benefit," says Dhakan.

Loan against FDs

The interest rates are typically one to two per cent higher than the rates paid on fixed deposits.

What's good: With interest rates for FDs of most tenures at 8-8.5 per cent currently, these loans could work out to be the cheapest among all asset-backed ones.

What's not: The loans are given for the same tenure as the FD and cannot be extended.

Suitability: If the requirement is more than three months, it is better to break the FDs rather than taking a loan against these, says Vijayasarathy. "The bank might charge a penalty of about 0.5 per cent for closing the FD but the net cost of taking a loan for someone in the highest tax bracket could work out to be 3.5-4 per cent." These loans are more tax-efficient for self-employed professionals, since they are allowed to deduct the interest on the overdraft taken against the FD.

Loan against insurance

The loan is given against the surrender value of the policy, the amount you will get if you exit before maturity. Such loans are usually given on endowment policies.

What's good: The interest charged is lower than for property and personal loans. Also, the possibility of a margin call is nil, unlike in the case of a loan against gold or shares. "The LTV ratio is high and borrowers can get up to 90 per cent of the surrender value," says Shetty.

What's not: You can take a loan against insurance only after three to five years of buying a policy. "The larger the surrender value, the bigger the loan you can take," says Shetty.

Suitability: "Avoid tinkering with insurance policies. Do it only in case of an emergency," says Shetty.

)

)