MFs push ahead with new offers despite tepid demand

Documents have been filed with Sebi to launch about 100 NFOs, mostly in equity category

Chandan Kishore Kant Mumbai Unperturbed by a tepid response to equity new fund offers (NFOs) in the past year, fund houses are pushing ahead with more.

Documents have been filed with the Securities and Exchange Board of India to launch close to 100 NFOs, mostly in the equity category. The fund houses include UTI Mutual Fund, Axis MF, ICICI Prudential AMC, Birla Sun Life MF and SBI MF.

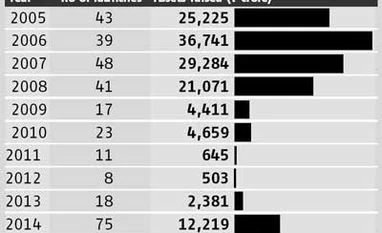

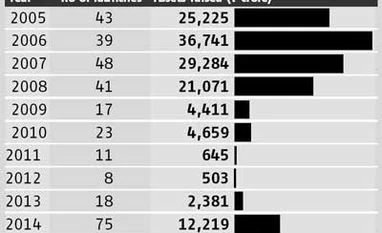

In calendar year 2014, which saw a rally of nearly 30 per cent in key Indian stock indices, the MF sector saw 75 new equity launches (mostly closed-end ones, attached with unreasonably higher commissions). This was the highest for the sector in its history. However, the total assets these new offers could raise was Rs 12,219 crore, against overall sales in the equity segment of Rs 120,623 crore, barely 10 per cent of total equity asset mobilisation.

Thus far in the first half of this calendar year, a total of 41 equity NFOs were offered to investors. While total money raised in equity was Rs 90,085 crore, these new offers could raise only Rs 6,484 crore or 7.2 per cent of total sales.

In sum, investors are preferring to invest in existing schemes with a record of performance. It also suggests that investors are much more mature and it's hard to lure them by the sales pitch of a cheap net asset value of Rs 10 a unit.

Fund houses maintain it is on the back of investors' interest that they launch new funds. The assets being raised through new schemes do not match what they claim.

Dhirendra Kumar, chief executive of fund tracking firm Value Research, says: "It is wrong to say that investors want new schemes; they aren't interested in these. It is understandable if a player launches a scheme to complete its basket of funds. However, I fail to understand why fund houses whose product basket is full continue to come up with new schemes."

Three years earlier, NFOs had lost flavour among fund houses. The trend seems to have reversed. As on end-June, the sector offered nearly 450 equity-oriented schemes (including equity linked saving schemes). Of which, 101 are closed-end ones. The number of equity schemes a year before was 378, of which only 46 were in the closed-end segment.

)

)