Sector funds: You can take the lump sum route

While SIPs work for all kinds of schemes, this route can maximise returns in certain sector funds

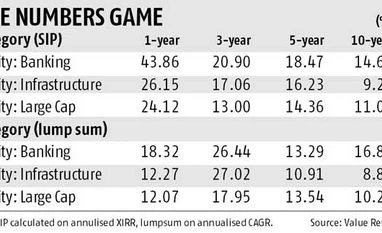

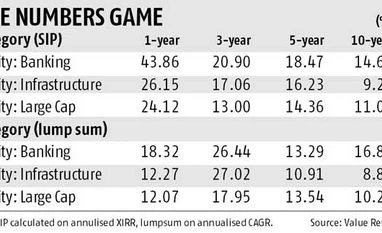

Joydeep Ghosh A little number crunching reveals an interesting trend: A systematic investment plan (SIP) in a banking fund would have returned 14.6 per cent annually in the past 10 years. However, a lump sum investment in a banking fund would have returned 16.9 per cent during the same period - a difference of about two percentage points a year in favour of lump sum investors. But investing through SIPs in the large-cap category would have given returns of 11.1 per cent whereas a lump sum investment would have returned 10.2 per cent - a benefit of around 80 basis points a year for SIP investors.

If one takes a five-year horizon, the difference is starker. SIPs in banking funds have returned 13.3 per cent annually, while lump sum has returned 18.5 per cent a year - a difference of about five percentage points per year. In comparison, the difference in returns of SIPs and lump sum in large-cap fund continues to be around 70-80 basis points in favour of SIPs, according to data from Value Research.

Clearly, some categories of mutual funds or stocks do better with lump sum investment, while others favour SIPs. Investing in sector funds requires a little more maturity, or as Wise Invest Advisor Chief Executive Officer (CEO) Hemant Rustagi puts it: "Investors need to be more particular when investing in sector funds." In some sectors, such as pharmaceutical or fast-moving consumer good (FMCG) funds, investors can always use either SIP or lump sum route because of their consistent performance. In others, especially ones which are cyclical, such as banking or information technology, one has to enter at the right time. "In such cases, a lumpsum investment could make more sense over the medium and long term," adds Rustagi.

On the other hand, large- or mid-cap funds consist of stocks from different sectors, thereby providing a balance to the overall portfolio. Therefore, while there is a marginal 80-100 basis point difference there between returns of SIPs and lump sum over the five- and 10-year periods, it does not really favour any particular style of investment. SIPs are recommended typically because it disciplines the investor leading to higher returns over the long term. The reason: When markets fall, investors in SIPs tend to gain because they get more units of the same scheme due to fall in the net asset value of the scheme. When the market turns around, the same additional units give a fillip to overall returns.

No wonder, Kotak Mutual Fund managing director, Nilesh Shah supports SIPs for all kinds of investments. "If you are a Kumbhkarna, then you can do lump sum investment in an equity mutual fund because you would have the ability to be a long-term investor. But most aren't. They get impacted by market volatility through fear and greed. SIP is suitable for diversified equity fund as well as sector funds." Shah says that while SIPs might not maximise, they help in optimising returns.

Interestingly, over the shorter term, say one-year, the trend reverses itself and SIPs earn better returns than lumpsum for both categories. But given the see-saw in the market, it is to be expected.

)

)