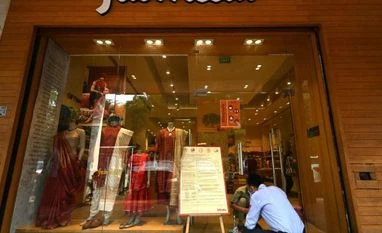

FabIndia plans Rs 4k-cr IPO; 750k shares to be given to artisans, farmers

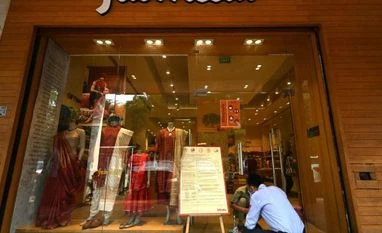

FabIndia's two promoters intend to transfer 400,000 shares and 375,080 shares to certain artisans and farmers, respectively, subsequent to the filing of the DRHP

)

Explore Business Standard

FabIndia's two promoters intend to transfer 400,000 shares and 375,080 shares to certain artisans and farmers, respectively, subsequent to the filing of the DRHP

)

Lifestyle retail brand FabIndia plans to raise up to Rs 4,000 crore through an initial public offer and in a novel approach, the company's promoters also plan to gift more than 700,000 shares to artisans and farmers.

On Saturday, the company filed the Draft Red Herring Prospectus (DRHP) with market watchdog Sebi for the offer that will include fresh issue of shares worth up to Rs 500 crore.

Besides, there will be an Offer For Sale (OFS) of up to 2,50,50,543 shares.

Market sources said the Initial Public Offer (IPO) is expected to be worth around Rs 4,000 crore.

In order to "reward and express gratitude to certain artisans and farmers engaged with the company or its subsidiaries", FabIndia's two promoters -- Bimla Nanda Bissell and Madhukar Khera -- intend to transfer 400,000 shares and 375,080 shares, respectively, to them, subsequent to the filing of the DRHP.

"Our promoters, namely, Bimla Nanda Bissell and Madhukar Khera have opened their respective demat accounts and have transferred 400,000 equity shares and 375,080 equity shares, respectively, that are proposed to be transferred by way of gift to the artisans and farmers," the DRHP said.

Proceeds from the fresh issue of shares will be utilised for voluntary redemption of the company's NCDs (Non Convertible Debentures), pre-payment or scheduled re-payment of a portion of certain outstanding borrowings and general corporate purposes.

In the DRHP, the company has mentioned about its ESG (Environmental, Social and Governance) initiatives, saying it believes that "enabling and uplifting the people we work with, taking care of the environment, and being ethical in our conduct with have a long and lasting positive impact".

"We have aimed to create social impact and foster economic well being for our artisans, communities, employees and investors, using environmentally responsible and ethical means," it added.

ICICI Securities Ltd, Credit Suisse Securities (India) Pvt Ltd, JP Morgan India Pvt Ltd, Nomura Financial Advisory and Securities (India) Pvt Ltd, SBI Capital Markets Ltd and Equirus Capital Pvt Ltd are the lead managers of the issue.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

First Published: Jan 22 2022 | 8:26 PM IST