IDBI Bank to sell stake in non-core businesses

The government's holding in IDBI Bank stood at 73.98 per cent as on December 2016

Press Trust of India New Delhi State-owned IDBI Bank on Tuesday said it has proposed to dilute stake in some non-core businesses to shore up capital base.

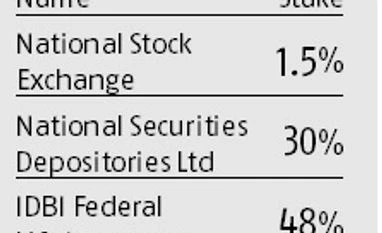

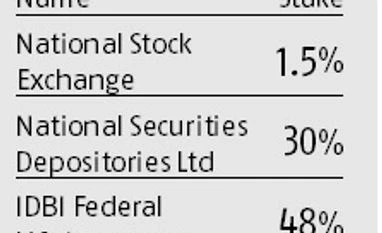

The board of the bank has approved in-principle proposal to divest some of its non-core investments, subject to compliance with all applicable laws and regulations and final approval obtained for each transaction, IDBI Bank said in a regulatory filing to the stock exchanges.

The decision was taken at the board meeting held on Tuesday.

Finance Minister Arun Jaitley in 2015 had hinted at a change in IDBI Bank wherein the government would continue to hold a majority stake, yet keep it at arm’s length.

Citing the example of Axis Bank, he had wondered if IDBI Bank could follow that model.

But since then, there has not been much progress on the plans due to one reason or another. IDBI Bank has a large portfolio of real estate, which was not taken into consideration during the valuation exercise.

The bank is looking at this aspect and trying to find a way out so that its valuation gets better.

As far as the stake sale of IDBI Bank is concerned, both the government and the bank’s board have already given nod for qualified institutional placement (QIP).

The government’s holding in IDBI Bank stood at 73.98 per cent as on December 2016.

“Public sector banks, including IDBI Bank, have been allowed to raise capital from public through follow on public offer (FPO) or QIP by diluting the government of India’s holding up to 52 per cent in a phased manner based on their capital requirement, their stock performance, liquidity, market conditions...” the government had informed Parliament in 2015.

Meanwhile, in a separate filing, the bank said it has deferred the agenda on issue of capital. “Regarding tentatively considering the agenda on issue of capital at the board meeting scheduled on February 21, IDBI Bank has now informed BSE that the said agenda could not be submitted for discussion at the board meeting held on February 21,” it said.

The same may tentatively be submitted in a subsequent board meeting for which a separate disclosure will be made under Sebi regulation, it said.

)

)