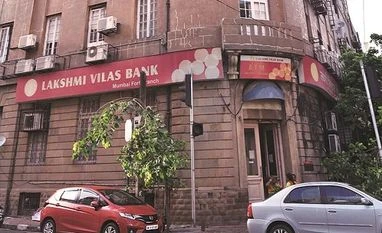

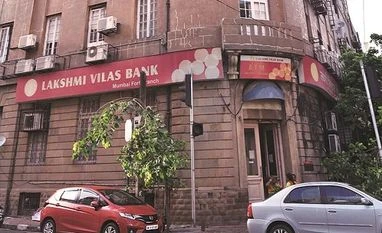

Look into RBI's culpability in Lakshmi Vilas Bank's failure: AIBEA

The bank employees' body said the merger of LVB with the Indian subsidiary of a Singapore-based bank is goes against the Centre's 'Aatmanirbhar Bharat' policy.

)

Explore Business Standard

Associate Sponsors

Co-sponsor

The bank employees' body said the merger of LVB with the Indian subsidiary of a Singapore-based bank is goes against the Centre's 'Aatmanirbhar Bharat' policy.

)

Bank employees' union AIBEA has said that the Reserve Bank's culpability in the failure of the 94-year-old Lakshmi Vilas Bank needs to be looked into and that the proposed merger of the lender with DBS Bank India Ltd (DBIL) will provide a back-door entry for a foreign banking entity into the Indian market.

In a letter to Finance Minister Nirmala Sitharaman on Wednesday, the All India Bank Employees Association (AIBEA) said the approach of merger of the Tamil Nadu-based lender with Indian subsidiary of a Singapore-based bank is opposite to the policy of Aatmanirbhar Bharat professed by the government.

The 94-year-old Lakshmi Vilas Bank (LVB) was profitable for 90 years and that the bank has been incurring losses for the past three years only, the association said.

"And, it is well-known that these losses are attributable to some huge loans given to few well-known delinquent borrowers. A thorough probe is needed as to why these loans were given knowing the negative credentials of these borrowers, why RBI did not advise the bank to exercise prudence in giving these loans, why RBI did not timely action on the erring top officials of that bank, etc," the letter said.

LVB's merger with DBIL will be effective from November 27 and the proposal was approved by the Union Cabinet on Wednesday.

Started by a group of seven businessmen of Karur in Tamil Nadu under the leadership of V S N Ramalinga Chettiar in 1926, LVB has 566 branches and 973 ATMs spread across 19 states and union territories.

With NPAs soaring, the bank was put under the Prompt Corrective Action framework of the Reserve Bank of India (RBI) in September 2019.

"RBI, being the monitor and regulator, is expected to protect the banks and its depositors/ customers and they cannot escape from their responsibility or accountability by just forcing a moratorium. RBI's culpability in the whole issue needs to be looked into," it said.

With the merger, DBIL will take over LVB in "as-is-where-is" condition and acquire over 560 branches and 973 ATMs for free, as per the letter.

"This is clearly a back-door entry to a foreign banking entity into the Indian market, overlooking RBI's rules on branch expansion of foreign banks in India. For DBIL with just around 35 branches, this is a big bonanza showered on them," it said.

According to the association, it is surprising that RBI has chosen to ignore the inherent value in LVB, and has recommended the government handover bank with pre-independence lineage to a foreign entity for free.

"Has RBI done any evaluation of the value of the LVB's network, and if so, why it has not been made public. The interests of so many lakhs of stakeholders are involved and RBI should have been more open and transparent," it noted.

LVB is an institution of long standing since 1926 and it has deep community links and a unique culture, the association said, adding that an amalgamation with a domestic lender would have been the right decision.

Further, AIBEA has told the finance minister that the matter needs immediate review and reconsideration in the national interest.

RBI had superseded LVB's board on November 17 after the crisis-hit lender was placed under a moratorium.

LVB is the second private sector bank after Yes Bank that has run into rough weather this year.

In March, capital-starved Yes Bank was placed under a moratorium. The government rescued Yes Bank by asking State Bank of India (SBI) to infuse Rs 7,250 crore and take 45 per cent stake in the lender.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

First Published: Nov 26 2020 | 4:22 PM IST