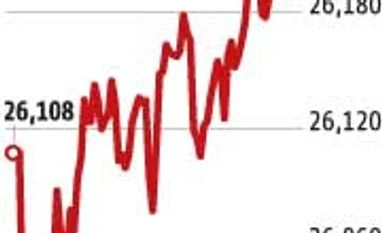

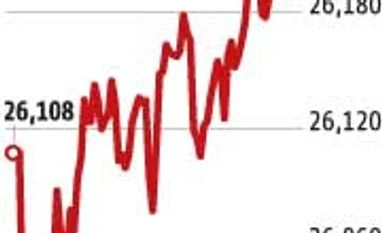

The benchmark BSE Sensex on Monday shook off an early stumble and settled 26 points lower at 26,192.98, as shares made a smart recovery on renewed buying interest from foreign investors and heightened rate cut hopes, despite feeble global cues.

The barometer index, which was down 250 points in early trade, bounced back on gains in power, banking and consumer goods stocks.

However, the uptick was tempered by weekend losses at US markets after the Fed's decision to keep interest rates unchanged sparked worries about global growth.

Jayant Manglik President Retail Distribution at Religare Securities said: "Markets started on weak note tracking feeble global cues and depreciation in rupee dollar in early trades.

But, things stabilised and the index gradually recovered." The index broke below the 26,000-mark in early trade by dropping 250 points to hit a low of 25,972.54, as investors booked profits in recent gainers amid mixed Asian pointers.

Thanks to across-the-board buying during the mid-session trade, the index reversed early losses to trade in positive terrain and touched a high of 26,233.46, before closing at 26,192.98, down 25.93 points or 0.10 per cent, retreating from its nearly three-week highs.

The gauge had gained 512.98 points in last two sessions.

"Strengthening rupee and hopes a rate cut by the Reserve Bank of India keeps the sentiment up of the street," said Gaurav Jain Director of Hem Securities.

The 50-issue NSE Nifty fell 4.80 points or 0.06 per cent to 7,977.10. It shuttled between 7,908.35 and 7,987.90 during the session. RIL was the biggest Sensex loser with a drop of 1.94 per cent, followed by Mahindra &Mahindra, ITC, Bharti Airtel and Dr Reddy's.

Asian stocks ended mixed after the US Fed decision last week to keep interest rates at record low raised fresh concerns about global economic growth. Key indices in Hong Kong, South Korea and Taiwan dropped between 0.75 per cent and 1.83 per cent, while China and Singapore rose by 0.09 per cent to 1.89 per cent.

European markets were trading mixed as indices in France and London rose by 0.62 per cent to 1.07 per cent while Germany was quoted lower by 0.36 per cent.

In the domestic market, 17 stocks out of the 30-share Sensex ended lower.

Major losers were RIL (1.94 pc), M&M (1.43 pc), ITC (1.32 pc), Bharti Airtel (1.14 pc), Dr Reddy's (1.11 pc), HUL (0.89 pc) and Lupin (0.76 pc).

However, Maruti rose by 2.64 per cent followed by Hindalco 2.43 per cent, Axis Bank 2.05 per cent, SBI 1.16 per cent, GAIL 0.99 per cent and Tata Motors 0.97 per cent.

Among the BSE sectoral indices, FMCG fell by 0.76 per cent, oil&gas 0.27 per cent, consumer durbales 0.19 per cent and metal 0.08 per cent, while power rose by 1.08 per cent followed by bankex 0.80 per cent, capital goods 0.50 per cent and realty 0.29 per cent.

Small-cap and mid-cap indices also rose 1.21 per cent and 0.44 per cent, respectively.

The market breadth remained positive, as 1,604 stocks ended in green while 1,032 finished negative and 133 ruled steady. The total turnover dropped to Rs 2,357.71 crore from the last Friday's level of Rs 4,593.90 crore.

)

)