Bank funding a concern for MSMEs in key sectors

The analysis indicates that the share of bank and institutional funding for MSMEs in these sectors is dwindling

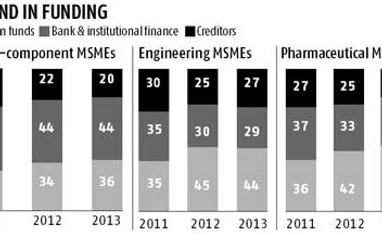

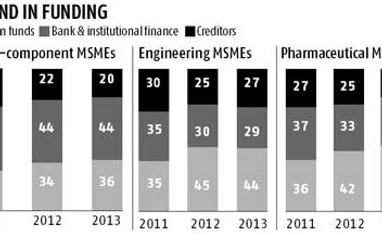

Business Standard New Delhi CRISIL has analysed the funding pattern of micro, small, and medium enterprises (MSMEs) in the pharmaceutical, engineering, and auto-component sectors from 2010-11 to 2012-13 (refers to the financial year, April 1 to March 31). The analysis indicates that the share of bank and institutional funding for MSMEs in these sectors is dwindling, and such enterprises are increasingly relying on their own resources to fund business growth.

Distributed widely across several geographic clusters, these MSMEs contribute significantly to the country's foreign exchange and leverage their easy access to a skilled and semi-skilled workforce to provide sizeable employment opportunities. As per CRISIL's study, MSMEs in the pharmaceuticals, engineering, and auto-component industries respectively employ an average of 143, 88, and 80 persons per unit.

CRISIL's study indicates that the share of bank and institutional funding to MSMEs in the engineering and pharmaceutical sectors declined by six per cent and three per cent, respectively, in the analysis period. Similarly, trade credit for these two sectors declined by three per cent and seven per cent, respectively. Bank funding for auto-component MSMEs declined by one per cent, albeit with a seven per cent slide in trade creditors. All these MSMEs are relying more than ever on fresh capital infusion, internal accruals, and unsecured loans from promoters, as in the case of enterprises operating in traditional sectors with low value-addition (see CRISIL's analysis on the leather and textile industries in Business Standard, April 15, 2014).

Improved access to bank and institutional funding to support capital investment and working capital requirement is critical for these sectors, given the vital role they play in the country's economy.

Note: The analysis is based on the latest audited financial statements and information of CRISIL-rated MSMEs. CRISIL rates over 50,000 MSMEs in India. This fortnightly tracker brings to our readers insights on MSMEs, a key element of the Indian economy.

)

)