Lower sales, coal realisation impact Tata Power in Q3

Analysts awaiting clarity over regulatory issues and rate increase for the Mundra project

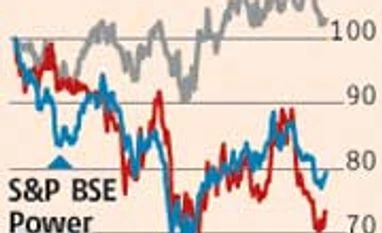

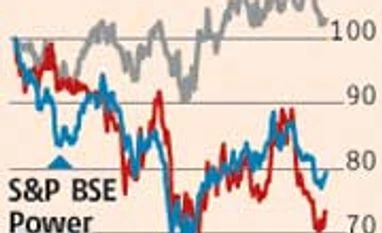

Jitendra Kumar Gupta Mumbai Tata Power narrowed its consolidated loss to Rs 75 crore for the December 2013 quarter (Q3) versus Rs 329 crore last year. The overall performance is still a far cry from estimates of the Street, which was expecting a net profit of Rs 223 crore on sales of Rs 9,329 crore. The stock fell from Rs 76 intra-day to a low of Rs 73.75 before closing at Rs 75 on Friday, a decline of 0.33 per cent over its previous closing.

A large part of the lower-than-expected profits can be attributed to the four per cent fall in revenues to Rs 8,700 crore, primarily dragged by its standalone power business (22 per cent of the total) wherein sales volumes declined and, secondly, the coal business. Standalone generation suffered due to lack of fuel and demand for its power. Similarly, the coal business was dented by lower realisations (gross impact of Rs 1,045 crore) despite a higher quantity of coal sold and gains from rupee depreciation (net impact Rs 142 crore). These partly offset the revenue gains in the Mundra ultra mega power project and Maithon project. The commissioning of all five units at Mundra (versus three last year) added Rs 483 crore to revenues, while the Maithon power project gained because of recovery of the fixed cost and solar business, adding Rs 215 crore to revenues.

However, lower generation and, to some extent, plant unavailability meant the company spent less on fuel costs (including purchases). On a consolidated basis, the two main components of costs namely the cost of power purchased fell 26 per cent to Rs 1,635 crore, while fuel costs dropped 14 per cent to Rs 2,307 crore. Some of these gains were offset by higher coal processing charges, transmission charges, royalty for the coal mining and other expenses.

Besides, other expenses jumped 29 per cent year-on-year, largely due to Rs 152 crore of provision and tax adjustment for previous years in the coal business, which saw segment profits fall to only Rs 17 crore versus Rs 444 crore last year. Thus, consolidated operating profit fell 3.8 per cent to Rs 1,786 crore. Further, other income stood at a negative Rs 94 crore (as forex loss increased 86 per cent to Rs 160 crore) versus a positive Rs 11 crore last year. This, along with higher finance, cost led to a consolidated loss of Rs 75 crore. These were lower than Rs 829 crore loss of last year wherein the company had taken an impairment charge of Rs 600 crore. While analysts say the quarter had a one-off impact to the tune of Rs 230 crore (gross), the profit is lower than expectations even after adjusting for the same.

Going ahead, the resolution on Mundra's tariff is crucial as any delay will have its implications on the company's balance sheet because of the high debt and profitability. Further, regulatory assets of about Rs 7,000 crore are yet to be approved and could weigh on the financials. Although the market believes the current valuations are attractive, given the regulatory uncertainties in the generation and distribution businesses, analysts are awaiting clarity.

)

)