Maharashtra explores options in state GST to ensure direct compensation to civic bodies

There may be a special law or a provision; state govt has estimated loss of Rs 14,000 cr after LBT and Octroi Duty are subsumed in GST

)

Explore Business Standard

There may be a special law or a provision; state govt has estimated loss of Rs 14,000 cr after LBT and Octroi Duty are subsumed in GST

)

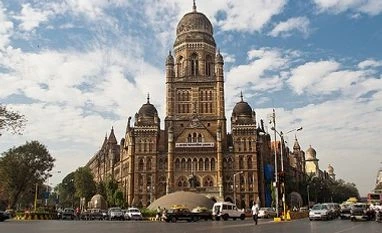

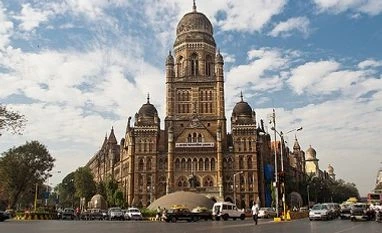

Maharashtra government will explore enactment of a special law as per the Article 243 X of the Constitution of India or inclusion of provision in the State GST to enable the direct transfer of compensation to civic bodies instead of routed through the consolidated fund. State has estimated that it will incur an annual loss of Rs 14,000 crore after the local body tax (LBT) and the Octroi Duty will be subsumed in the GST. Of the Rs 14,000 crore, state will have to refund Rs 6,000 crore to 25 municipal corporation for their loss in LBT and Rs 8,000 crore to the BrihanMumbai Municipal Corporation (BMC) towards Octroi Duty loss.

The ruling BJP and Shiv Sena as well as opposition Congress and Nationalist Congress Party during their representations to the finance minister Arun Jaitley had expressed fear that finances of civic bodies will deteriorate if they aren't assured direct compensation within a stipulated time frame. Shiv Sena, which is in driver's seat in the BMC, argued that method of quick recovery of revenue loss back to the state and local bodies must be ensured otherwise local bodies will collapse.

A state finance department official who did not want to be identified said: ''Finance Minister Arun Jaitley in his reply has already announced that the government is sympathetic to the government's demand for due compensation to be given to the civic bodies. Jaitley has suggested that the state government can enact a special act say Assignment of Funds to Local Bodies Act under Article 243 X of the Constitution of India so that the government can assign the due amount to the civic bodies from the compensation it receives from the Centre. Secondly, the state government can include a provision in the State GST to ensure that civic bodies get their share directly.'' The officer said the Article 243X is with regard to power to impose taxes by, and funds, of, the Municipalities The Legislature of a State may, by law.

He informed that the government will seek the view of the state law and judiciary department before taking a final decision in this regard.

First Published: Aug 04 2016 | 5:54 PM IST