Relief for taxpayers: There's more in your hands now

Increase in investment limit under 80C, basic exemption limit, PPF and home loan interest payment are good news

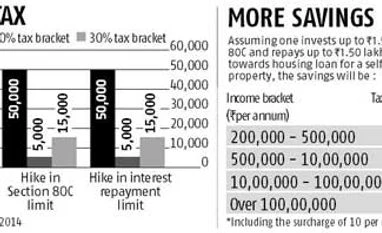

BS Reporter New delhi There is good news for consumers reeling under inflation. Finance Minister Arun Jaitley has put more money in their hands. The basic tax exemption limit for those below 60 years has increased by Rs 50,000 to Rs 2.5 lakh. Similarly, the investment limit under Section 80C of the Income Tax (I-T) Act that qualifies for tax exemption, the Public Provident Fund (PPF) limit, and the annual interest payout towards housing loan that would attract tax benefit have also seen increases of Rs 50,000 each.

“I propose to increase personal income tax exemption limit by Rs 50,000; that is, from Rs 2 lakh to Rs 2.50 lakh for individual taxpayers. I also propose to raise the exemption limit for senior citizens from Rs 2.5 lakh to Rs 3 lakh,” Jaitley said in his maiden Budget speech.

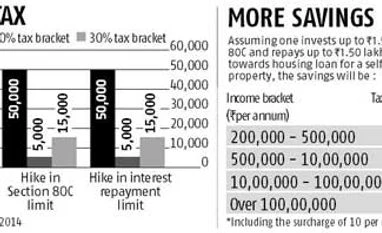

Rajesh Srinivasan, partner with Deloitte in India, says: “All the three hikes of Rs 50,000 each will help individuals save anywhere between Rs 5,000 (in the lowest tax bracket of 10 per cent) and Rs 15,000 (in the highest tax bracket of 30 per cent) on each of the benefits.”

If all three deductions are taken into consideration, then, higher the tax bracket the higher will be your annual saving. That’s why many feel Jaitley has announced a pro-affluent middle-class Budget, unlike his predecessor, who did not leave enough in the hands of those in the higher tax bracket.

The finance ministry did not change the tax slab rates. The present slab rates are: zero tax for up to Rs 2 lakh, 10 per cent tax for Rs 2-5 lakh income bracket, 20 per cent for Rs 5-10 lakh bracket and 30 per cent for incomes above Rs 10 lakh. Those with incomes above Rs 1 crore are charged an extra three per cent tax for a surcharge of 10 per cent on the slab rate of 30 per cent. However, no changes were made in surcharge/cess in the Budget announced on Thursday.

There is yet another category of income earners — very senior citizens — whose basic exemption limit is Rs 5 lakh. There was no change announced for this category.

“I propose to increase the investment limit under Section 80C from Rs 1 lakh to Rs 1.5 lakh,” Jaitley said. It was expected that this limit would be raised to Rs 2 lakh. However, before he announced an increase in Section 80C limit, the finance ministry raised the investment limit for public provident fund (PPF) to Rs 1.50 lakh from Rs 1 lakh now.

PPF will continue to be an attractive option for investors, since the interest income is tax-free and there is an attractive rate of return, currently 8.70 per cent. Employee Provident Fund (EPF) also earns a tax-free return of 8.75 per cent for 2013-14. It might be revised to nine per cent for 2014-15. Other debt products such as bank deposits, earning anywhere between 8.50 and nine per cent (for tenure of one year and above), do not offer tax-free income. That takes the after-tax returns from bank deposits to 5.95-6.30 per cent.

Lastly, the finance minister increased the deduction limit on account of interest repaid towards housing loans from Rs 1.50 lakh to Rs 2 lakh. However, this is applicable only for self-occupied house property and not those rented out.

Kuldip Kumar, executive director (tax and regulatory services) at PricewaterhouseCoopers India, says the Budget announced a clarificatory amendment for house owners. Till now, you would get tax benefits for buying a house property from the sale proceeds of another such property. However, there was no clarity on whether the second property should be bought in India or abroad. Many would take advantage of this loophole and claim exemption for properties bought abroad as well. “This time, the finance minister clarified that tax benefit can be availed only if the second property is bought in India,” he says.

Jaitley said he plans to reintroduce the Kisan Vikas Patra (KVP), a popular small saving instrument, to encourage people with banked and unbanked savings to invest in it. Tax experts feel KVP could be included to qualify under Section 80C.

Experts feel the relief measures announced now are only a token and that there might be more substantial measures over the next two Budgets.

)

)