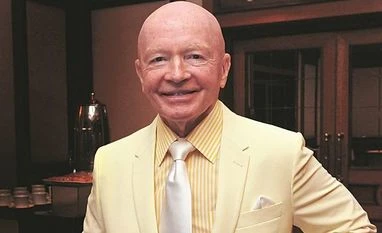

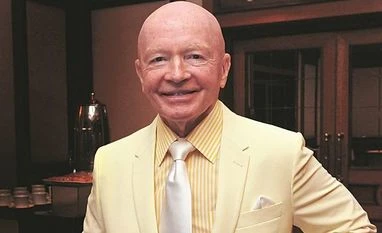

Mark Mobius joins Hong Kong-based Chartwell Capital as strategic advisor

Founded in 2007, Chartwell Capital is an independent, Hong Kong-based investment firm that focuses on China's Greater Bay Area and the Asia-Pacific region.

Puneet Wadhwa New Delhi Mark Mobius has joined Hong Kong-based Chartwell Capital in a non-executive, independent advisory capacity. Founded in 2007, Chartwell Capital is an independent, Hong Kong-based investment firm that focuses on China’s Greater Bay Area and the Asia-Pacific region.

The company favors family-controlled, small-to mid-capitalisation companies and places an emphasis on collaborative engagement with its portfolio companies.

Chartwell Capital currently serves institutional clients such as endowment and pension funds, charitable foundations, family offices, and high-net-worth individuals.

“Hong Kong is a place of personal and professional significance for me, as it's where I began my journey in fund management. It remains a vital international finance center and a key access point to China. I'm optimistic about the Hong Kong stock market's future, and I see unique opportunities amid the market's downturn. I believe Chartwell Capital has the right approach and positioning to navigate this landscape successfully,” Mark Mobius said.

Best known for his role at Franklin Templeton Investments where he managed one of the world’s first emerging markets (EM) funds, Mark Mobius helped grow the group’s EM assets under management from $100 million to $50 billion prior to his departure in 2018.

In the same year, he founded Mobius Capital Partners with two former colleagues. Mobius has also contributed to developing international policies for emerging markets. He served on the World Bank's Global Corporate Governance Forum as a member of the Private Sector Advisory Group and as co-chairman of its Investor Responsibility Task Force in 1999.

)

)