Sovereign green bonds trading at IFSC to start in 2nd half of FY25: RBI Guv

The government has been raising funds through green bonds since 2022-23 and has raised a total of Rs 36,000 crore in the last two years

)

Explore Business Standard

The government has been raising funds through green bonds since 2022-23 and has raised a total of Rs 36,000 crore in the last two years

)

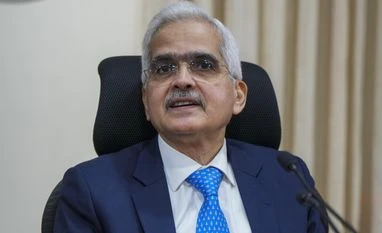

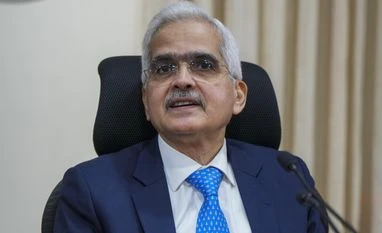

Reserve Bank Governor Shaktikanta Das on Saturday said trading of sovereign green bonds can commence at the International Financial Services Centre in Gujarat during the second half of the current fiscal.

"We are in discussion with the IFSC, it will be operationalised very soon. I think in the second half (of the current financial year), it will be possible," Das said.

In April, the Reserve Bank of India (RBI) had announced that it will issue a framework to enable the trading of sovereign green bonds in GIFT City.

The government has been raising funds through green bonds since 2022-23 and has raised a total of Rs 36,000 crore in the last two years.

So far in the current financial year, the government has raised only Rs 1,697 crore out of the stipulated Rs 12,000 crore scheduled to be raised in the first half ending in September through green bonds as it did not find favourable bids.

Asked about the tepid response from investors to such bond issuance, Das said, "as the debt manager of the government, we are watchful of what exactly is happening and if something needs to be done we will interact with the government and deal with it."

He further said, one major announcement in this year's budget about developing a climate taxonomy.

"I think that will have a significant long-term impact on mobilisation of funds for the green sector, not only through green bonds but also overall financing of the green sector," he said.

"We will develop a taxonomy for climate finance for enhancing the availability of capital for climate adaptation and mitigation. This will support achievement of the country's climate commitments and green transition," Finance Minister Nirmala Sitharaman had said in her Budget speech for 2024-25.

Earlier in the day, Sitharaman addressed the board members in the post-budget 609th RBI's Central Board Meeting held here.

First Published: Aug 10 2024 | 3:56 PM IST