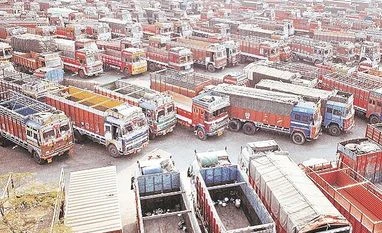

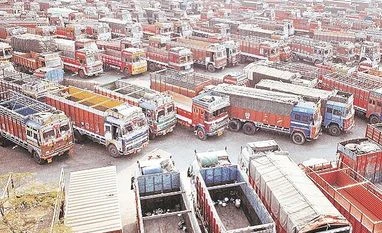

India's commercial vehicle (CV) sales in the domestic market declined 23 per cent on a year-on-year basis while production fell 27 per cent during the first half of the current financial year, in continuation with the demand slowdown that has dragged down the industry in several past months.

The trend continued in September as the production of CVs slipped to 4,09,153 units from 5,59,514 units a year ago, data by the Society of Indian Automobile Manufacturers (SIAM) shows. Domestic sales declined to 3,75,480 units from 4,87,319 units in the same quarter last year. Exports declined by 41.58 per cent to 30,564 units from 52,319 units a year ago.

Mitul Shah, Vice President-Research Auto, Reliance Securities, said that despite de-stocking by CV players, inventory continued to remain high owing to feeble retail demand and customers deferring purchase decision in view of expected higher discounts towards end of the fiscal on the back of expected flash sale of BS-IV vehicles owing to BS-VI transition at the end of FY20.

"After inventory destocking, existing inventory continues to remain at higher-than-normal level for most players, which would continue to impact the wholesale dispatches in the second half of FY20. Few companies also announced production cut during last three months to adjust inventory level in light of demand situation. We expect massive production cut in 3QFY20 for CVs and 2Ws, while passenger vehicles (PV) production would remain more or less normal," Shah said.

SIAM said the slowdown in the commercial vehicle segment may continue in Q3FY20 owing to the implementation of various regulations including BS VI emission norms, fire suppression - school bus, reverse parking and fuel efficiency, in 2020.

Domestic sales of medium and heavy commercial vehicles (M&HCV) also witnessed a sharp decline of 62 per cent to 14,855 units in September as compared to 39,210 units during the same period of last year. Production fell to 12,304 units from last year's 44,057 units, as per SIAM data.

In M&HCV segment, the downfall in retail sales was slightly lower in September this year, as the companies have started correcting inventory at factory level as well as at dealer level, analysts said. Overall retail sales were impacted due to pause on incremental capex and falling freight rates amid lower agri production. Therefore, the cargo segment witnessed 65 per cent year on year volume fall, while the bus volume declined by 25 per cent YoY and LCV volume fell by 23 per cent YoY.

"Freight rates for medium and heavy commercial vehicles (MHCVs) have been under pressure for the last few months, indicating lower utilisation level for trucks caused by lower freight demand and higher freight capacity after revised axle norms. Additionally, transporters shied away from purchases in the first half of September in anticipation of a GST cut," said Hetal Gandhi, director, CRISIL Research

Wholesale offtake of goods carrying commercial vehicle during September dipped 39 per cent year-on-year.

"Demand for light commercial vehicles (LCV) too fell, although not as significantly as their heavier counterparts, due to slowdown in private consumption and weak finance availability despite a festival build-up," Gandhi said.

)

)