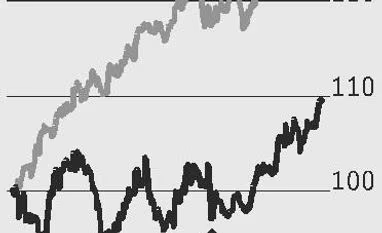

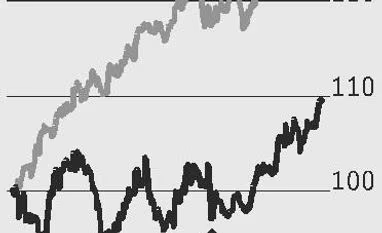

Stocks of IT majors have gained up to four per cent over the past week on expectations that IT budgets of North American companies could trend higher.

Over 60 per cent of revenues for top IT firms come from North America, and revenue visibility, given a positive management commentary by Accenture, could lead to a growth upcycle. On Accenture results last week, analysts at Morgan Stanley had said, “Revenue beat, uptick in lower end of guidance, record growth in new bookings, among others, bode well for Indian IT vendors and could reflect positively on the stock sentiment.”

One of the key verticals where Accenture has done well is financial services (or BFSI, banking, financial services and insurance). After single-digit growth in prior two quarters, financial services have grown at 11 per cent year-on-year (y-o-y). In the past, Indian vendors have followed Accenture on the recovery graph, with a lag of two quarters. Analysts, however, say it may be too early to conclude if this is the trend.

There is higher pent-up demand in the financials services space, with companies spending on new regulations such as the Markets in Financial Instruments Directive (European Union legislation for investment intermediaries) and technologies. This should help IT biggies such as Tata Consultancy Services (TCS) and Infosys, as the vertical with a share of 33 per cent of revenue is by far the biggest among various segments the two operate in.

Unlike peers which have been circumspect about their financial services outlook, Wipro expects the financial services vertical to outgrow its overall average revenue growth in FY18 as it continues to see a healthy traction across the board, including Europe.

The recovery in top line should also help to stabilise or improve margins. TCS’ management, according to analysts at Edelweiss Securities, does not expect pricing or cost pressures in existing or new deals to impact the profitability.

Pressures in the form of wage hikes and other cost pressures are expected to largely be offset by healthy execution and automation.

While valuations are not demanding, investors should await consistent demand growth before taking exposure to the IT space.

)

)