The Indian-made foreign liquor (IMFL) market could decline by as much as 20 per in FY21 because of issues around distribution as well as tax hikes by states, executives at top liquor firms have told Business Standard.

This will be the sharpest fall in four years, they say, as various states increase tax on alcohol.

On Wednesday, Uttar Pradesh, Karnataka, Rajasthan and Tamil Nadu increased taxes on alcohol by 10-15 per cent, joining Telangana, West Bengal, Delhi and Andhra Pradesh, who had announced tax hikes of 16-75 per cent on liquor on Tuesday.

The IMFL market had last fallen by 2 per cent in FY18 to 308 million cases, growing 5.5 per cent in FY19 to 325 million cases and 1.5 per cent in FY20 to 330 million cases.

Maharashtra has not hiked taxes for now, but has shut liquor shops in Mumbai, which is a large market, contributing 12-13 per cent in terms of sales volume to the overall liquor market.

Tax revenue from alcohol is estimated at Rs 700 crore per day or Rs 2.5 trillion annually, says Amrit Kiran Singh, chairman, International Spirits & Wines Association of India (ISWAI), whose members include top liquor players such as Diageo and Pernod Ricard.

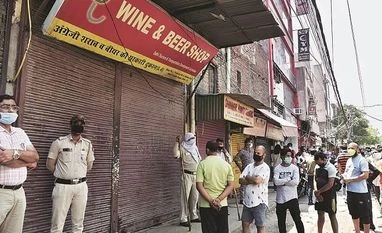

“The industry was slowly coming out of a situation where shops, which were shut for 40 days, were reopening (on Monday) and there was business that happened due to latent demand among people. The long queues were a result of that,” says Deepak Roy, executive vice-chairman and board member, Allied Blenders & Distillers, the makers of the Officer’s Choice whisky brand.

“Now you have the spate of tax increases by states that will make alcohol prohibitive in terms of price. This will be detrimental to the market,” he says.

Almost 70 per cent of alcohol distribution in India happens through liquor vends or shops, while 30 per cent happens on-premise, that is, in bars, pubs, and hotels. The latter continue to remain closed in view of social distancing norms.

Distilleries were looking to resume production in green and orange zones to fill the distribution pipeline. But, with a likely hit in volumes, many are likely to stagger production now, experts say.

Some states have permitted home delivery of liquor, including West Bengal, Punjab and Chattisgarh to stem the fall in sales. States such as Haryana and Rajasthan may also take that route in the near future.

)

)