With fears of a temporary ban on sales in Delhi of large diesel vehicles being extended to other cities, Mahindra & Mahindra, India's biggest maker of sports utility vehicles (SUV), is considering reducing the size of its engines.

According to a Supreme Court order passed on Wednesday, the registration of SUVs and other diesel cars with an engine capacity of 2,000cc or more is banned in Delhi and the National Capital Region till March 31.

The Mumbai-based company, which will bear the brunt of the order, has five vehicles with engines above 2,000cc, including the country's best selling utility vehicle, Bolero.

“We are working to see what we can do with the vehicles that are otherwise banned. We will examine redesign to come below the two-litre limit,” Pawan Goenka, executive director, M&M, told analysts on Wednesday.

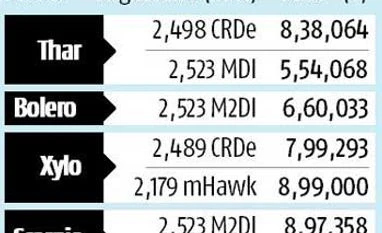

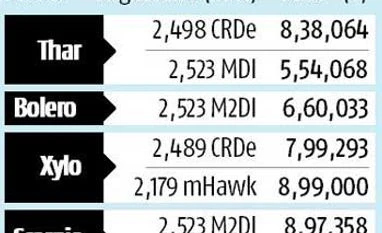

Except for the recently launched TUV3OO, all other M&M utility vehicles like the Bolero, Scorpio, XUV5OO, Thar and Xylo have engines larger than 2,000cc.

The XUV5OO, M&M's most expensive product, for instance, has a mHawk, 2179cc diesel engine. For the company to retail this product in Delhi-NCR, M&M will have to bring down the capacity to 2,000cc or below.

“We are concerned about the inventory with dealers, which is in the order of Rs 100 crore. We do not have a solution for that yet. Dealers are unduly coming under pressure,” added Goenka.

“Technically, it is possible to downsize engines to below a specific value if it is within a certain range. If all other parameters remain the same, there will be a negative effect on power. But such an effect can be compensated through a recalibration, which will anyway be warranted if displacement is reduced,” said an engineer who recently worked on a new diesel engine for one of India's passenger vehicle manufacturers.

Changes will have to be made to manufacturing systems and parts procurement from vendors, besides putting the vehicle through a rigorous test cycle before launch.

“It is possible to reduce the volume of the engine. But, a lot depends on the type of technology the engine uses. Any change will require time and money. The manufacturer will have to change the machining line, maybe change pistons and crankshafts, too,” said a senior engineer at a Delhi-based automobile company.

This is not the first time that M&M has had to tweak its products to meet altered norms. In 2013, the company reduced ground clearance of the XUV5OO by 40 mm to 160 mm to be eligible for the three per cent excise duty cut allowed in that year's Union budget. “Just four per cent of M&M's national passenger vehicle volumes come from the Delhi-NCR region. The fear is that it (the order) can spread to other cities. The fact that the (M&M) management has said it can tweak engines to suit the norms gives some confidence to investors,” said Bharat Gianani, senior automobile research analyst, Angel Broking.

Tata Motors, whose six models, including the Safari and Aria, will be affected by the ruling, has not ruled out an M&M-like move.

"We are exploring all options at the moment. While remaining committed to the environment, we believe it is imperative that the regulatory regime looks holistically at emission control rather than only at a particular technology or fuel. Given the key advantages of diesel in terms of the efficiencies it offers as well as the evolution in its technology in recent years that makes it a favoured fuel in regions such as Europe, we believe it has an important role in the long-term fuel strategy," Tata Motors said in an e-mail.

Swedish car maker Volvo has said it will work on engines only below 2000 cc for both petrol and diesel. In India, a variant each of the S60 and XC60 will be affected by the ban even as the S80 is discontinued and will be replaced by the S90 in the later part of next year.

)

)