Monsoon Impact: Pure play fertiliser majors face earnings risk

Below normal monsoon poses a threat to Coromandel and Chambal Fertilisers, while others with diversified product and geographic presence will fare better

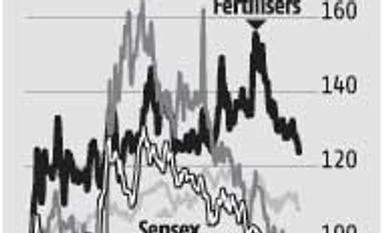

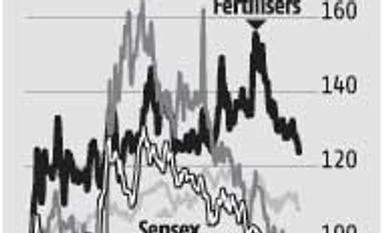

Ujjval Jauhari New Delhi Fertiliser companies are concerned about sub-par monsoons in the current season. Companies such as Chambal Fertilisers, Coromandel International, Gujarat State Fertilizers & Chemicals (GSFC), and Deepak Fertilisers all hit their 52-week lows in the past few days. The concerns are not misplaced, as these companies see the largest impact on their financials in years when the monsoon is not normal. ICICI Securities in a recent report says it is arguably the most sensitive sector to rainfall. While companies post healthy sales growth during good monsoon years, they register negative growth during bad monsoon years.

Further the impact of below normal monsoon, followed by unseasonal rains, is likely to make matter worse. Analysts at Emkay Global say the implication of decline in value of produce and profitability for the agriculture sector (during FY15) is likely to play out with a lag on agri-input sectors, such as seeds, fertilisers and agro-chemicals. Impact of top line growth moderation can partly be offset by the recent decline in commodity prices.

Further, if we look at the weak monsoon of 2009, 2012 and 2015, players with higher exposure to domestic market and the fertilisers segment have seen larger impact on their earnings. In comparison, other bigger peers with diversified portfolio offering other agri-inputs as such as seeds, contract research or exports like UPL, Bayer Cropsciences, Rallis or PI Industries have some cushion and the impact has not been as severe.

Analysts say agri chemicals and complex fertilisers are likely to be impacted the most. Urea players enjoy the buffer due to government subsidy. Brokerages prefer companies with asset light flexible business models such as Sharda Cropchem and Dhanuka Agritech or those with significant export exposure like UPL, PI Industries and Rallis India. Initiation of structural reform, rationalising urea consumption, will potentially benefit complex fertiliser players such as Coromandel International and Tata Chemicals.

Among fertiliser companies, Coromandel International is the largest company by market capitalisation and remains the top pick of most analysts. The valuations after corrections have become attractive and increasing utilisation levels are expected to add to profitability. Also, any reforms could boost profits further. Analysts at Edelweiss say Ebitda margins in fertiliser business are expected to improve on better operating leverage and higher utilisations and recommend a ‘buy’ with target price of Rs 360, nearly a 50 per cent jump from the current levels. The key risks to their estimates are execution delays in capacity expansion at Kakinada plant and also poor monsoon that can hit fertiliser demand.

For Chambal Fertilisers, analysts are looking at government’s decision on policy for production beyond cutoff and long-pending issues such as high subsidy receivables and balanced usage of nutrients which will act as triggers. Analysts at HDFC Securities have a ‘buy’ rating, with a target price of Rs 74. They feel valuations are cheap at 6.9 times earnings and 0.9 times book value for FY17, which coupled with a dividend yield of three per cent protect the downside. Poor monsoon, however, is a major overhang.

PI Industries, the most preferred stock in the agri-input pack, is well positioned, as the custom synthesis business contributes about 59 per cent of its revenues and is also more profitable. This provides cushion from vagaries of monsoon, as agri-inputs only contribute 41 per cent to overall revenue. However, the company is also trading at very rich valuations. Analysts at India Infoline say while there is good visibility in earnings growth, the strong multi-year growth is already discounted in valuations and hence they see limited upside for now.

UPL, another diversified player having exposure to Latin America, Europe and emerging markets, get well cushioned from domestic vagaries with about 60 per cent revenues coming from outside the country. Though analysts at Angel had projected UPL to post an annual growth of 15.0 per cent and 20.0 per cent in its sales and profits respectively, over FY2015-17, poor monsoon could impact, as India contributes about 43 per cent (the March quarter).

For Rallis, the improving seed portfolio and new crop protection products are likely to continue driving the growth. Analysts at Religare say Rallis is developing a strong non-pesticide business, which will reduce cyclicality in its business. However, the recent forecast of below normal rains will definitely be a dampener to growth and pose challenges.

)

)