Private entities face CAG heat for Rs 2,700-cr tax anomalies

560 high-value cases under scanner

Ishan BakshiSahil Makkar New Delhi The Comptroller and Auditor General of India (CAG) has found tax anomalies to the tune of Rs 2,700 crore in 560 high-value cases pertaining to corporate and individual tax payers for 2014-15.

The CAG is likely to name these parties in its report to Parliament in the Budget session, sources have told Business Standard.

In the case of Videocon Industries, the CAG audit found the assessing officer had allowed set-off of minimum alternate tax (MAT) credit of earlier year against the allowable MAT credit. This mistake led to excess allowance of MAT credit to the tune of Rs 30 crore. In the case of Vodafone East India, the CAG audit found the assessee took advantage of MAT credit available for set off for 2006-07 to 2009-10, even when there was no MAT credit available for set-off. As a result of this audit, the tax liability increased by Rs 24 crore including interest.

Contrary to the general perception that the CAG only audits public sector, public-private ventures and government schemes, India's top financial audit body has a much wider mandate. Under Section 16 of the Comptroller and Auditor-General's (Duties, Powers and Conditions of Service) Act, 1971, the organisation can "audit all receipts which are payable into the Consolidated Fund of India". The CAG uses this Section of the Act to audit direct tax receipts, including corporate and income tax, and indirect tax receipts such as central excise, customs and service tax.

For instance, under the system of direct taxes, the income tax (I-T) department randomly selects 230,000 cases of tax payers for scrutiny of the 30 million-odd total taxpayers every year. Income-tax officers manually check whether the party has correctly filed its tax liability according to the existing tax code. CAG officials, then, seek records of such cases from the I-T department to further validate the tax claims made by the corporate and private individuals.

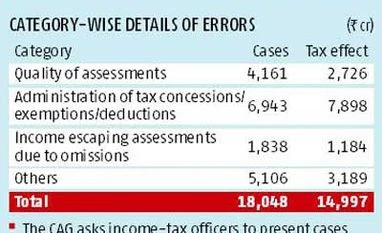

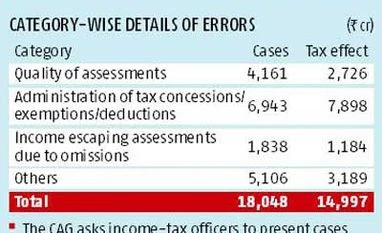

"This is done to see whether the income tax officer was right in his assessment and also to find any errors in the returns filed by a company or an individual," a CAG officer said on condition of anonymity. The CAG has been doing these audits since 1972. If the CAG finds any anomaly, it seeks an explanation from the assessing officer of the I-T department. In its latest report ending March 2015, the CAG has identified 19,540 such cases with a tax liability to the tune of Rs 16,000 crore. Such liability arises due to quality of assessment, administration of tax concessions, exemptions, deductions and income escaping assessment due to omissions.

Of these 19,540 cases where the tax liability is estimated to be below Rs 50 lakh, the CAG leaves it to its regional offices to see through the cases. It, however, has set a target for its regional offices to report high values cases to the head office where the tax assessment is above Rs 50 lakh. For instance, Mumbai has been asked to report 110 cases, followed by Delhi (80), Chennai (60) and Bengaluru (25).

After a thorough scrutiny, the CAG sends these cases to the Central Board of Direct Taxes (CBDT) for appropriate action. If the CAG receives a satisfactory response from the CBDT, the case is dropped. Else, its mention in the report to Parliament. The finance ministry is, then, supposed to act on the CAG report within four months of being presented in the House.

)

)