The Lodha committee has received proposals totalling more than Rs 3,300 crore from realty and infrastructure players to buy large parts of the huge land bank accumulated by PACL (formerly Pearls Agrotech Corp).

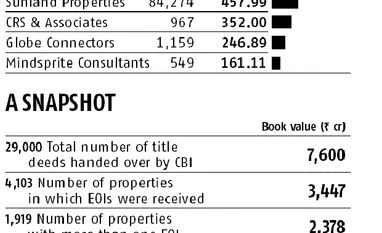

Companies like Sunland Properties, WS Infra, CRS & Associates, and some individuals have written to the committee, expressing an interest in big chunks of properties, some of them running into thousands of acres. These proposals cover land and other properties across a dozen states including Delhi, Maharashtra, Karnataka, UP, MP, Andhra, Telangana, and Tamil Nadu.

Separately, the company’s promoter, Nirmal Singh Bhangoo, has also submitted a proposal from some buyers offering to buy the properties at “double the circle rate”. According to his proposal, the prospective buyers were willing to buy the properties at double the base price or circle rate as may be fixed by the committee.

Also, the prospective buyers were ready to deposit the agreed amount of sale in one go within “a short and reasonable period”.

In another significant proposal, Delhi-based builder Great Value Projects India has offered to take over all the properties and return the money to investors. It has sought a month’s time to conduct the due diligence and valuation of the properties and submit a detailed scheme for the return of the amount owed to investors.

The committee has appealed to the Supreme Court, seeking suitable directions on the matter.

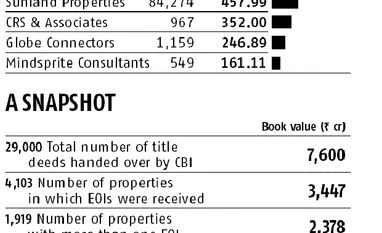

Bulk purchases are one of the options being considered by the committee, which faces obstacles in its task. These are apart from 112 properties worth Rs 83 crore it has sold so far through the auction process, which commenced last year. Though potential buyers had shown an interest in over 1,560 properties, the sale could be completed only for these because several objections came in the way and bidders pulled out in the later stages. To ensure a proper price discovery, properties where a single bidder was interested did not go under the hammer.

The panel has also received a little less than Rs 15 crore as proceeds from the auction of 47 luxury cars seized from PACL.

The committee said it was not able to commence disbursement to investors because it needs Rs 1,500-2,000 crore to begin disbursement for even the first set of investors, who have dues of Rs 1,500 or less. There are about 10 million investors in this category. If Rs 1,500 was to be distributed to all 51.5 million investors on a pro-rata basis, Rs 7,500-8,000 crore would be required.

The panel had initially, keeping in view the urgency involved and the timelines specified by the court, commenced with the auction of immovable properties on an “as is, where is, whatever is” basis. “However, the auctions have not been able to achieve the desired result and it has thus become necessary in order to effectively sell the immovable properties, a suitable agency needs to be appointed which will undertake to investigate title, check encumbrances, and conduct the factual verification of the property condition within an expedited time period,” it said.

Citing the issues it has encountered over the past one year, the committee has told the court “that the process of bringing to sale and recovering monies for effecting refunds to investors would be a long drawn out on involving costs associated therewith”.

PACL was allegedly carrying on an investment scheme, though it dressed it up as a real estate activity of purchase and sale of land parcels across the country. In the process, it had accumulated vast tracts of land, a large part of those being barren agricultural land. After a protracted legal battle that dragged on for over 15 years, the Securities and Exchange Board of India had directed the company to refund Rs 49,100 crore, along with interest, in August 2014. A year later, the order was confirmed by the Securities Appellate Tribunal.

In the meanwhile, various agencies, including the Central Bureau of Investigation (CBI), Serious Fraud Investigation Office, and Enforcement Directorate (ED) have been probing the case. During one such probe, the CBI had seized thousands of property documents belonging to the group. Following this, in February 2016, the Supreme Court had entrusted with the committee, headed by former Chief Justice of India RM Lodha and including officials from Sebi, the task of selling various properties belonging to the company and refunding money to the investors.

)

)