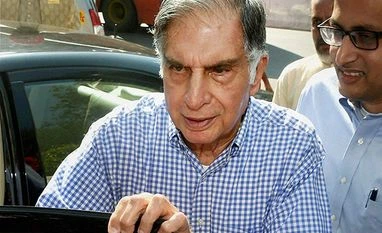

A day before Tata Sons' crucial general meeting to seek shareholders' approval to become a private company, Chairman Emeritus Ratan Tata said the face of Tata group would change in 10 years, and as long as it operates with ethical standards and value systems, he would feel very proud.

Speaking to CNBC TV18, Tata, 80, said the group is in very able hands of Chandra (N Chandrasekaran, chairman, Tata Sons).

“The face of Tata may change over the next 10 years, and so long as there is still the same drive to make this an enterprise or a conglomeration of enterprises that operate with ethical standards and value systems, I would be very proud,” Tata said. “Some group companies will die and the new ones will be born, but the group must always be ethical,” the patriarch of India’s largest group said.

He also said he would like to be remembered as a person who made a difference, "not anything more and not anything less".

On the role of Tata Trusts, he said they had gone through, and are going through, a transformation to stay relevant in today’s world.

The annual general meeting, to be held on Thursday, will decide on preference shareholders getting voting rights if the company skips dividend for two or more years.

While the warring Mistry family is expected to vote against the resolutions on going private and giving voting rights to preference shareholders, it would be a smooth affair for Tata Sons, as the Tata Trusts and Tata companies hold requisite majority to get the resolutions passed.

The Mistry family is expected to raise the issue of Tata Sons going private in the National Company Law Appellate Tribunal (NCLAT)'s next hearing, where its earlier petitions on oppression of minority shareholders are being heard.

The Tata group is facing its biggest challenge ever, with its telecom company making huge losses, the small car project becoming a non-starter after huge investments and some of its overseas acquisitions not yielding desired results. With a new management in place, the group hopes to turn around its fortunes.

On Wednesday, group company, Tata Steel, announced that it had signed an agreement with ThyssenKrupp of Germany to form an equal partnership joint venture. With its European operations out of the way, Tata Steel will be able to focus on the growing India markets.

SES bats for Tata Sons’ proposal to go private

Proxy advisory firm Stakeholders Empowerment Services (SES) said it does not find anything wrong with Tata Sons’ proposal to go private, from the corporate governance point of view, and said it could not be termed oppression of minority shareholders. “This does not, in any manner, adversely impact any shareholders of their rights and obligation. It aims to preserve the character of the company as a private one, which it has for almost a century. In fact, there is status quo for all shareholders,” the company said. BS Reporter

)

)