The Gujarat-born brand, Balaji Wafers, is taking a big leap on to the national stage. With a star endorser and a new campaign, the home grown wafers label that debuted inside a movie theatre in Rajkot (in its snacks canteen) more than three decades back, wants a place beside the Goliaths in the business.

Experts say that this is the best time for a small brand to aim big, but warn that Balaji has two big challenges to contend with. One it is to still to crack the taste test, nationally and secondly it has to find a differentiator (other than price) to take on big chips makers—from PepsiCo Lay’s and ITC Bingo to Haldiram’s and others—who have been steadily localising their product and pitch. Is it ready for battle?

Jay Sachdev, marketing manager of Balaji Wafers says the brand has been steadily building up the arsenal. He adds, “A strong distribution network across the country is a must in order to become a national brand. We currently have 800 strong distributors and the number is increasing. To be a credible choice nationally, the brand must also deliver more than the expectation of the consumer even at the lowest price point. We have both of these things on point. India being a diverse country also translates to diverse taste buds. Integrating that into our products is something we are working on, alongside our branding campaigns.”

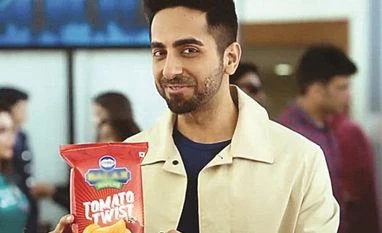

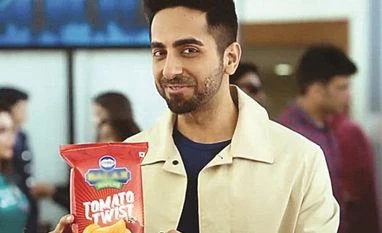

So far its colourful packaging and attractive price points have helped. The packaging was revamped around a year back, in keeping with a more youthful clientele the brand seeks, and now a set of ads have been released with popular actor Ayushmann Khurrana. All of this is in anticipation of the brand’s national sojourn.

Defined as savoury snacks including fruit snacks, chips/ crisps, extruded snacks, tortilla/corn chips, popcorn, pretzels, nuts and other sweet and savoury snacks, the Indian market is worth around Rs 38,644.25 crore (2019), according to Euromonitor International. It is led by Lays, Haldiram’s and Bingo with Balaji Wafers at fourth position.

Currently present in 10 states in the West and South, Balaji will need to define its positioning very sharply to take on the leaders say experts. “Balaji always comes up in our reports despite being a regional brand and has a high brand recall in the markets it is present. But still they are a regional brand. They have not hit out as Haldiram has done. First thing the brand has to do is to think differently,” says CEO of TRA Research N Chandramouli.

Sachdev explains that one of the changes brought about is a sharp focus on youth, whereas in the past the brand identified all ages as target groups. But in its current avatar, Balaji is specifically looking at millennial and post-millennial consumers. “Hence, we have changed our packaging design and are introducing specific products that target such a young audience.” Some of the new products being planned are stackable chips (as in Pringles), Nachos, peanut and sesame chikki which it intends to market as 'India’s own protein bar’.

A bigger product portfolio points in the right direction, but Chandramouli believes stock keeping units (SKUs) will be critical for a national launch. “One has to have very fast moving SKU in snacks to make it to large and medium retailers. Currently, this seems to be missing. Also, they will have to differentiate in this crowded category,” he said. Stacked chips, for him, do not amount to thinking differently.

Harish Bijoor, founder Bijoor Consults thinks the brand ought to spend more time over its image and identity. “You could have a great product but if your brand imagery doesn’t percolate into regions where consumers don't know you, it may not be successful. For now, Balaji Wafers sounds regional. They have to work on relevance and how the brand will resonate across 29 states. They need to keep in mind that they are not just 29 states but 29 separate regions and hence, strategies will vary accordingly,” adds Bijoor.

)

)