A week after the electronic-way (e-way) bill was deferred on the day of its country-wide launch, companies are grappling with inconsistency among states over its rollout.

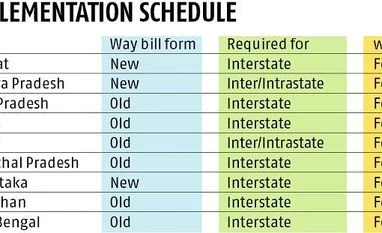

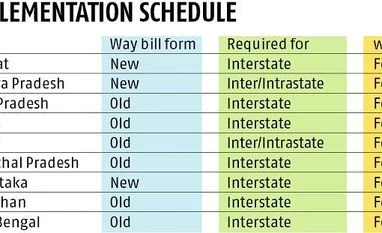

Several states have notified different dates for implementation of the way bill in the old and new formats to track movement of goods across and within states, causing confusion in industry.

Gujarat has notified February 21 as the date for introducing the inter-state e-way bill in the new format, while Andhra Pradesh has notified e-way bills will be applicable from February 8.

Assam, Himachal Pradesh and West Bengal have said the old way bill will continue for inter-state movement of consignments. Uttar Pradesh has notified February 10 for bringing back the old way bill, while Rajasthan has notified it for inter-state movement for 33 commodities.

Bihar has announced a Rs 50,000 threshold for inter-state goods movement and Rs 200,000 for intra-state movement for continuation under the old way bill.

Companies in industries like fast-moving consumer goods, pharmaceuticals and consumer durables are apprehensive because their consignments pass through several states and rules differ in each of them.

The goods and services tax (GST) revenue slowdown had prompted the GST Council to advance the rollout of the e-way bill for inter-state movement of goods to February 1 and for intra-state carriage the date is June 1.

The states had discontinued their old way bill mechanism on February 1, the day of the launch of the e-way bill. With the postponement of the centralised e-way bill system through the GST Network, states are bringing back their old systems. However, there is apprehension and anxiety across sectors.

“The GST Council should ideally intervene and persuade all states to implement the system on the same date and through the common portal. The option of first introducing the inter-state e-way bill should be explored, which can then be expanded to include intra-state transactions as well,” said Pratik Jain, partner, PwC India.

Bipin Sapra of EY pointed out that the ambiguity in the requirement for way bills in each state needed to be resolved. "The industry is apprehensive of possible delays this may cause," he added.

The e-way bill system is being developed by the National Informatics Centre (NIC), while other IT matters related to the GST are managed by the GST Network (GSTN), a private body.

An advance of Rs 400 million has been given to the NIC to implement the e-way bill mechanism.

"Businesses would prefer a nationwide uniform roll out of the e-way bill, initially for inter-state transactions. Once the entire system is stable it can be considered for intra-state movements as well. Any business disruptions on account of the e-way bill should be avoided," MS Mani, partner, Deloitte India.

E-way bills will help the central and state tax authorities to track movement of goods. A tax commissioner or an officer empowered by him or her will be authorised to intercept any conveyance to verify the e-way bill or the number in physical form for all supplies.

The law committee of the GST Council will meet on Friday to discuss issues requiring clarification and amendments in rules. The issues relate to the aggregate value of transactions and for sales returns.

Companies are in a fix over how the e-way bill will apply in case of returns. “If I sell and send a consignment to a customer who does not accept it, who will issue the e-way bill in case of return of the consignment?” asked an executive with an FMCG company. “Our truck will supply eatables to 50 small retailers in one trip. How many way bills do I generate?” the industry asked.

Bihar Deputy Chief Minister Sushil Modi had flagged the need for an efficient mechanism to avoid disruptions. He had also recommended the appointment of a nodal officer to address hurdles in the functioning of the e-way bill system.

The GST Network has asked the finance ministry for 15 days time to fix the problems.

)

)