The New Year has begun on a positive note for domestic airlines, with oil marketing companies reducing jet fuel prices 12.5 per cent on Thursday, the steepest cut since July. Between October and December last year, jet fuel prices declined 11 per cent.

Though the move will bring relief to airlines, it is unlikely to lead to reduction in airfares.

In Delhi, the price of jet fuel has been cut from Rs 59,943 a kilolitre to Rs 52,423 a kilolitre.

This is the first time in about four years when the price of aviation turbine fuel has dropped to about Rs 52,000 a kilolitre. In February 2011, the price of the fuel in Delhi was Rs 53,063 a kilolitre.

Fuel costs account for about 40 per cent of an airline’s operating expenses. Domestic airlines pay more for fuel than their regional peers, owing to state and central levies.

For airlines, hit hard by high fuel costs for much of 2013 and the first part of last year, the drop in jet fuel prices will mean lower operating costs. Last financial year, domestic airlines together posted a loss of about Rs 9,700 crore. However, with crude oil prices at about $60 a barrel, the outlook looks bright.

The Jet Airways and SpiceJet stocks reacted favourably to the price cut. While Jet Airways closed nine per cent higher at Rs 419, the SpiceJet stock closed at Rs 18.05, up five per cent.

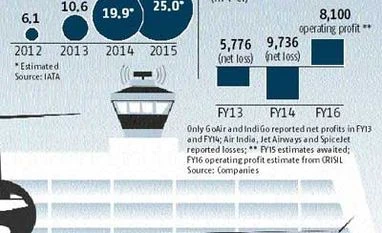

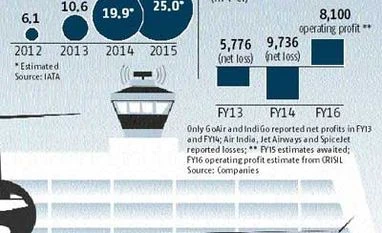

In its forecast last month, the International Air Transport Association (IATA) had said in 2015, global airlines would post a collective profit of $25 billion on the back of falling crude oil prices and economic growth. It has revised its profit outlook for 2014 from $18 billion to $19.9 billion.

“The industry outlook is improving. The global economy continues to recover and the fall in oil prices should strengthen the upturn next year,” IATA Director General Tony Tyler said in a statement.

Credit rating firm CRISIL expects Indian carriers to post an operating profit of Rs 8,100 crore in 2015-16. However, Air India, Jet Airways and SpiceJet aren’t expected to report net profits, as they are in need of fund infusion.

Prasad Koparkar, senior director (industry and customised research), CRISIL Research, said, “We believe Indian airline companies will have one of the best business environments to operate in for a long time. Falling crude oil prices are a big positive. We expect about 25 per cent lower air turbine fuel prices for FY16, compared to FY14. More importantly, the fall is accompanied by an improving demand scenario, unlike FY10, when players were unable to benefit significantly due to weak demand. We expect average passenger traffic growth to be 10-12 per cent through the next couple of years.”

“We expect all airlines to report profit in FY15, except Air India and SpiceJet. The fourth quarter, a weak period for travel, will be benefited significantly by low fuel prices and capacity reduction by SpiceJet. We feel IndiGo’s profitability will be further strengthened and could surpass its best result (profit of Rs 787 crore) till date,” said Kapil Kaul of the Centre for Asia Pacific Aviation.

Airlines will not pass the cut in aviation fuel prices relief to passengers. “Average fares are already low in India. The jet-fuel price reduction is much needed and a welcome relief, given the high structural and operating costs in India. The reduction will help airlines become more viable,” said Sanjiv Kapoor, SpiceJet chief operating officer.

An Air India executive said, “Most of the time, airlines sell below costs. Only when fuel prices are down over a sustained period can we think of a reduction in fares.”

Last year, airlines consumed about Rs 18,000 crore worth jet fuel for domestic flights. “Jet fuel prices are now down 24 per cent from their June 2014 peak. Based on FY14 volume and June prices, the cost reduction for us would be about Rs 700 crore. Our actual fuel consumption this year will be lower,” said Kapoor.

)

)