Core sector output rose a paltry 0.4% in June, as compared to the 4.1% rise in May.

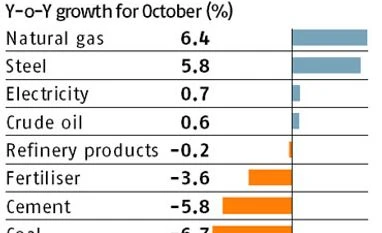

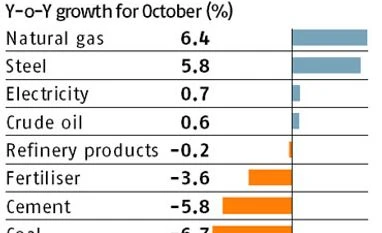

There was contraction or marginal growth in six of the eight segments, with only growth in natural gas and steel pulling up the index.

Data issued by the commerce and industry ministry on Monday showed the eight core segments - coal, crude oil, natural gas, refinery products, fertiliser, steel, cement and electricity - cumulatively grew 2.4% in the first three months (April-June) of this financial year. This was less than half the 6.9% growth in the corresponding period of 2016-17.

April also saw lower growth of 2.8%, after 5.2% growth in March.

"The considerable dip in June 2017 from the previous month was driven by an unfavourable base effect that contributed to the worsening contraction in output of coal and cement, and sharp deterioration in the performance of electricity generation and refinery output," said Aditi Nayar, vice-president at ratings agency ICRA.

Contributing 40% to total industrial production, core sector output rose in May mainly due to a significant increase in the electricity segment, supported by refinery products and natural gas.

In June, however, the electricity sector managed to rise by only 0.7%. Data indicates thermal electricity generation fell two%, in sharp contrast to the year-on-year expansion of 6.8% in May, ICRA said. In addition, the pace of growth of hydro electricity generation moderated for a second month, to 10.9% in June from 15.8% in May, partly reflecting an unfavourable base effect, it said.

The slowest growth was in crude oil production, up only 0.6% after a 0.7% rise in May, following contraction in the month before. However, it's close cousin of natural gas saw production rise by 6.4%, maintaining a steady trend in the quarter. It grew 4.5% in May.

Growth in steel production also rose to 5.8%, from the 3.7% rise in May. Expansion ended there; every other sector saw contraction. Coal output fell for a third month, doing so in June by the highest margin of any sector. It contracted by 6.7%, after a 3.3% fall in May.

"The continued contraction in coal output in May is likely to reflect inventory management, following the double-digit growth in March," Nayar had said earlier.

Cement production fell 5.8% in June. After prolonged contraction in output for five months, it saw modest growth in May and analysts thought this could mean a nascent turnaround in construction activity. However, ICRA expects demand growth here to recover to four to five% during FY18, driven by a pick-up in the housing and infrastructure segments, particularly, roads and irrigation, Nayar added.

Refinery products contracted by 0.2%. It had risen by 5.4% in May, reversing a trend of very low or negative growth for four months.

Finally, fertiliser production again contracted in June, going down by 3.6% after a 6.5% decline in May. The sector had seen four months of contraction until April, when it had risen by 6.2%.

)

)