Banks are bracing themselves for more stress in the agriculture sector in coming quarters on account of farm loan waivers by various state governments.

This might impact credit offtake in farm lending, which is witnessing a slowdown due to write-offs.

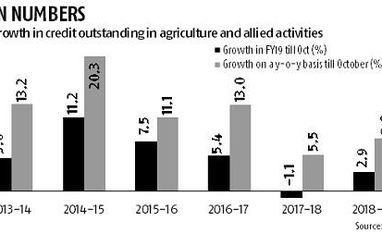

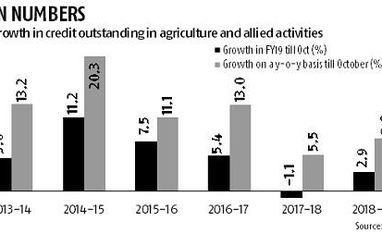

According to the Reserve Bank of India (RBI) data, for the last two years, credit growth in the agricultural sector has been lacklustre, and much lower than what it was in the previous years. Between April 2017 and now, various state governments have announced farm loan waivers, and after that agriculture credit growth nosedived, the data from the RBI shows.

Before states started announcing debt waivers, in April-October 2016, year-on-year agricultural credit growth was around 13 per cent, and from April 2016 to October 2016, growth was around 5.4 per cent.

According to a top executive of a public sector bank, while all non-performing assets (NPAs) in agriculture have not been recognised because they are frequently restructured, it is turning out to be one of the most stressed sectors in the economy, and in the next quarter, banks might have to increase provisioning to account for possible defaults owing to loan waivers.

Four states — Assam, Chhattisgarh, Madhya Pradesh and Rajasthan — have announced farm loan waivers.

Earlier, S S Mallikarjuna Rao, managing director and chief executive officer of Allahabad Bank, said, “Because of the debt waiver declared by various states and also because not everybody can be covered under debt waiver, there is impact on repayment culture. As a result, the bank had to make efforts in recovery.”

In April 2017, Uttar Pradesh gave a farm loan relief amounting to about Rs 364 billion. In May 2017, Maharashtra announced a farm loan waiver of Rs 305 billion. In June 2017, Karnataka announced a farm loan waiver of around Rs 82 billion. In October 2017, and Punjab’s farm loan waiver was about Rs 100 billion. Other states that have announced a farm loan waiver or relaxation include Tamil Nadu, Andhra Pradesh and Telangana.

Puducherry has also done so.

According to priority sector lending norms, scheduled commercial banks have to extend 40 per cent of their loans or adjusted net bank credit (ANBC) to identified priority sectors. Of this, 18 per cent is earmarked for the agricultural sector, within which a target of 8 per cent of ANBC is prescribed for small and marginal farmers.

Banks that fail to meet the targets need to deploy amounts equal to the shortfall in the low-yielding Rural Infrastructure Development Fund.

)

)