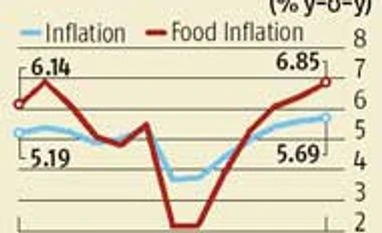

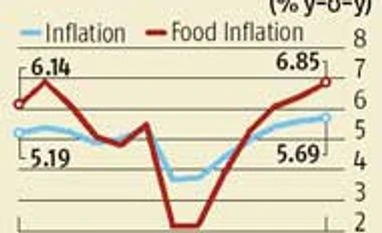

Retail inflation at 17-month high of 5.69% in January

The inflation rate in January, however, was more favourable than RBI's comfort-zone target of 5.8 per cent for the month

BS Reporter New Delhi Retail inflation in January inched up to a 17-month high of 5.69 per cent, led mainly by a sharp acceleration in food prices, suggesting any interest rate cut by the Reserve Bank of India might be considered only after April.

Consumer Price Index (CPI)-based inflation, the central bank's primary gauge for price increase, had stood at 5.61 per cent in December. January was a fifth straight month of rise, with pressure from pulses, meat and fish, and spices, data released by the Central Statistics Office showed on Friday.

The inflation rate in January, however, was more favourable than RBI's comfort-zone target of 5.8 per cent for the month. RBI had cut the repo rate for a fourth time this year in September, to 6.75 per cent.

With the inflation trajectory on an upside, the September was probably the last interest rate cut by the central bank for the financial year.

The rate of retail food inflation shot up to 6.85 per cent in January, versus 6.4 per cent in December, mainly on account of shortage in pulses supply.

The CPI combined core inflation stood at 4.7 per cent during the month.

Food & beverage inflation in the month was up at 6.67 per cent, whereas vegetables saw increase in the inflation rate for a fourth straight month, to 6.39 per cent.

Inflation in pulses eased slightly to 43.32 per cent in January, against 45.9 per cent the previous month, but remained high despite the government's efforts in offloading seized pulses in the market to check prices and boost availability.

Fuel inflation eased to 5.32 per cent in January from 5.45 per cent in December, despite a series of excise duty hikes in petrol and diesel, led by a drop global crude oil prices.

The economy clocked 7.3 per cent growth in the quarter ended December and was estimated to expand by 7.6 per cent in the current financial year, according to data released by Central Statistics Office earlier this week.

Domestic demand in the economy has failed to pick up, despite easing of interest rates by the central bank.

This has in turn led to a cut in lending rates by banks, easing loan instalment pressure on individuals to an extent.

)

)