StatsGuru: 10-June-2013

Decoding the rise and fall of gold as an investment

Business Standard New Delhi Gold continues to worry India's policymakers, who have just announced a further increase in import duty by two percentage points to eight per cent, when it was practically nothing a relatively short while ago.

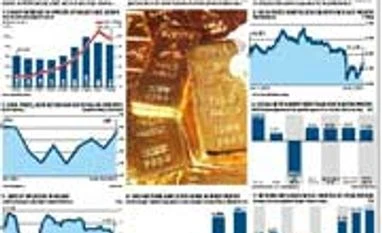

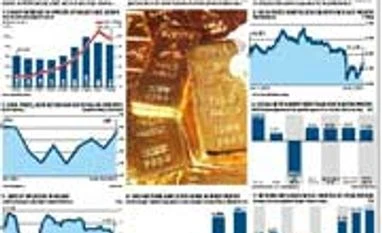

The reason is visible in Table 1: The sharp increase in gold imports by value since 2008, although it is estimated, perhaps hopefully, that it tracked downwards in 2012-13. Partly this is because the actual volume of gold imported has gone up, on average, since the middle of the last decade. Partly it is because prices, too, have been high. However, recent weeks have introduced something of a twist into this discussion: Table 2 shows that prices have fallen sharply over the past month. The effect on imports is not clear. As Table 3 shows, sustained high prices and government action had caused a slight fall-off in import volumes in recent quarters - but the drop in price has made the metal more attractive, since not everyone believes it will be sustained.

Government action to control gold imports and ease the current account deficit must tackle the root cause of the problem: That gold has been a far better investment bet over some horizons than comparable instruments, as Table 4 shows. Even debt has barely done better than inflation rates, shown in Table 5, over the past five-year period - but gold has grown in value enormously.

This has led to a surge in the amount of money in gold-backed exchange-traded funds, shown in Table 6. It is worth noting, however, that investors expecting steady increases in value from gold ETFs will have been unpleasantly surprised by returns in the one-year or six-month periods, as shown in Table 7. What that will do to demand for gold as an investment is another imponderable for policymakers.

)

)