CD rates remain elevated despite liquidity comfort

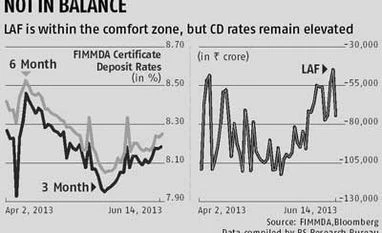

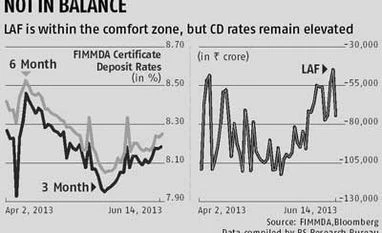

Neelasri Barman Mumbai Although the liquidity situation is within the Reserve Bank of India’s (RBI) comfort zone, Certificates of Deposit rates (CDs) have remained elevated amid high supply before the end of the first quarter.

CDs are promissory notes issued by banks and are short-term instruments of fund raising. The three-month rates are currently at 8.18 per cent, six-month at 8.25 per cent and one-year at 8.38 per cent.

While average borrowing under RBI’s liquidity adjustment facility stood at about Rs 85,000 crore since April, this is slightly above the central bank’s comfort zone of +/- one per cent of net demand and time liabilities (NDTL).

“CD rates are high because of the first instalment of corporate advance tax deadline on June 15. There is outflow towards advance tax, estimated at Rs 30,000-40,000 crore. There are also three-month CD maturing in June and there will be repricing of these CDs,” said Ajay Manglunia, senior vice-president, Edelweiss Securities. Manglunia added there was not much appetite for longer tenure CDs in March and hence, a majority of the issuances were in three-month CDs.

The demand for CDs has also come down, resulting in rates being elevated. “Money is moving away from short-end to longer duration funds, due to which incremental requirement for CDs is less. Due to advance tax-related outflows and quarter-end redemption, mutual funds are playing slightly safer. Their demand for CDs is lesser,” said Dhawal Dalal, executive vice-president and head of fixed income at DSP BlackRock Mutual Fund.

However, the rates will start easing once June ends and a new quarter begins. “CD rates may ease by 25-30 basis points (bps) up to three-month, while longer-tenure CD rates may ease by 15-20 bps,” said Dalal.

According to some experts, RBI might cut the cash reserve ratio (CRR) further tomorrow, which will help liquidity available with the banks improve and cost of funds come down. “If there is a CRR cut, then the CD rates will come down by July,” said Arvind Chari, senior fund manager (fixed income) at Quantum Mutual Fund. Chari said he expects RBI to cut CRR by 50 bps tommorow.

CRR is the proportion of total deposits a bank has to keep with RBI as cash. Currently, the CRR is at four per cent of banks’ NDTL. Since January 2012, the CRR has been cut by 200 bps.

)

)