India Inc makes a beeline to raise bonds as rates drop

Corporate bond rates fell upto 30 bps after RBI's rate cut

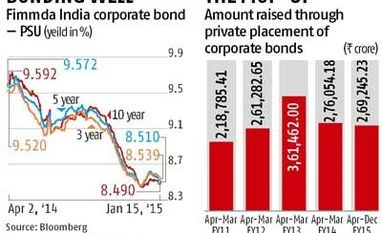

Neelasri Barman Mumbai Following the surprise rate cut by the Reserve Bank of India on Thursday, India Inc is set to benefit from the lower cost of raising funds. According to estimates, the cost of borrowing through private placement of bonds fell about 30 basis points on Thursday. And, with expectations of further rate cuts, fund-raising will only turn cheaper.

The Reserve Bank of India (RBI) had, on Thursday, cut the repo rate (at which it lends to banks) by 25 basis points to 7.75 per cent, owing to more comfort on inflation and the government’s commitment to meeting its fiscal deficit target.

“On Thursday, Steel Authority of India raised Rs 500 crore through five-year bonds; the coupon rate was 8.3 per cent. Before the rate cut, the rate would have been more than 8.5 per cent. Coupon rates have dropped by 15-20 basis points and, in a couple of cases, more than 30 basis points. On Friday, IL&FS raised 10-year bonds at 8.72 per cent; a couple of weeks ago, it had raised 10-year bonds at nine per cent,”said Ajay Manglunia, senior vice-president (fixed income), Edelweiss Securities.

State Bank of Patiala, Power Grid Corporation of India, Rural Electrification Corporation and Power Finance Corporation have lined up bond issuances through private placements in the near future.

“There are expectations of further rate cuts, of 50-75 basis points, in 2015. Accordingly, we could see a fall in the cost of borrowing by way of bonds. If there’s no rate on February 3 (the central bank’s next monetary policy review) but RBI makes dovish statements, a similar fall in coupon rates might not happen but at least a softer bias for rates will continue,”said Arvind Konar, head of fixed income, Almondz Global Securities.

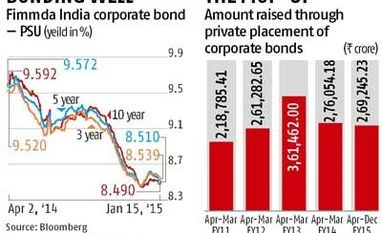

Data from the Securities and Exchange Board of India show India Inc raised Rs 2.69 lakh crore in April-December 2014, compared with Rs 2.76 lakh crore during FY14.

Broadly, it is expected RBI will keep the repo rate unchanged on February 3, as it might wait for the Union Budget to be presented first. Budget 2015-16 is scheduled to be announced later that month.

“The key to further easing is data confirming continuing disinflationary pressures. Also critical will be sustained high-quality fiscal consolidation, steps to overcome supply constraints and assured availability of key inputs such as power, land, minerals and infrastructure. The latter would be needed to ensure potential output rises above the projected pick-up in growth in the coming quarters,”RBI Governor Raghuram Rajan said on Thursday.

Consumer Price Index (CPI) inflation rose an annual 5 per cent in December compared with a rise of 4.38 per cent year-on-year in November 2014, the slowest pace in data going back to January 2012. But despite a rise in CPI inflation, it was below market expectations.

The fiscal deficit for the current fiscal is pegged at 4.1 per cent of Gross Domestic Product (GDP) while for the next fiscal it has been targeted at 3.6 per cent of GDP.

)

)