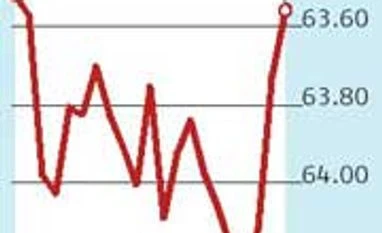

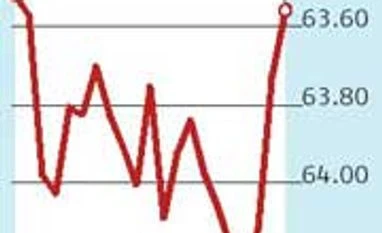

Rupee ends at 1-month high; bond yields fall to 3-week low

The yield on the new 10-year bond ended at 7.71 per cent on Friday, compared with the previous closing level of 7.76 per cent

BS Reporter Mumbai The rupee ended at a one-month high on Friday tracking gains in the stock market. While the improving outlook of the monsoon led to bond yields softening further. The rupee ended at 63.56 compared with the previous closing level of 63.73. It had ended at 63.52 on May 22.

"Dollar sale by banks and exporters helped the rupee to appreciate. Concerns pertaining to interest rate hike by the US Federal Reserve have eased and the monsoon outlook has improved which is helping the markets," said Suresh Nair, director, Admisi Forex India.

The yield on the new 10-year bond ended at 7.71 per cent on Friday, compared with the previous closing level of 7.76 per cent. It had ended at 7.64 per cent on June 1. The yield on the 10-year benchmark bond ended at 7.88 per cent compared with the previous closing level of 7.95 per cent. It had ended at 7.82 per cent on June 1.

The Sensex soared 200 points to end at 27,317 and Nifty surged 50 points to close at 8,225. Above-normal monsoons, positive macroeconomic numbers coupled with a dovish stance by the Fed bolstered the rally.

"The improving outlook of the monsoon will help to soften inflation and that is positive or the bond market. The Reserve Bank of India (RBI) is in discussion with the government to set the foreign institutional investors (FIIs) limit for government debt in rupee terms instead of dollars. This is positive for the bond market," said Ashutosh Khajuria, president (treasury), Federal Bank.

The FII limit for government debt currently stands at $30 billion and is near full. A shift from dollar to rupee will lead to enhancement of the limit. Meanwhile, on Friday RBI's government bond auction worth Rs 15,000 crore sailed smoothly. The auction included a new 30-year bond for Rs 3,000 crore.

)

)