Rupee to remain stable in 2016: BS Poll

12 of 13 responded rupee to remain well within its record low level of 68.85/$

Anup Roy Mumbai The rupee will largely remain stable but with a mild depreciating bias in the next one year, despite the expected four rate increases by the US Federal Reserve and even rate cuts by the Reserve Bank of India, said currency dealers in a poll by Business Standard.

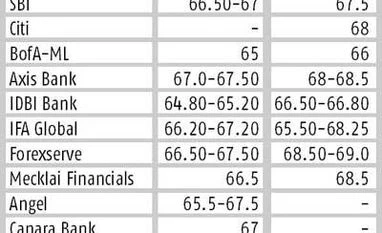

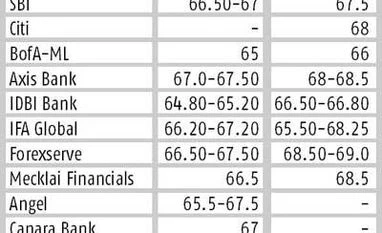

While 12 of the 13 polled expected the rupee to remain well within its record low level (68.85 a dollar, reached in August 2013) by December 2016, one participant expected it to touch 70 due to global credit market volatility. Till the end of this financial year, though, rupee should remain well within the range it is trading now.

The currency closed at 66.40 a dollar on Friday and all 13 participants expect it to revolve around this level.

Theoretically, money flow is based on the interest rate differential. Hence, if the source country increases its rates, the recipient country should also raise these, to maintain the same differential. In the case of India, a squeeze in the interest rate differential will be largely inconsequential, with the country's robust fundamentals, said senior currency market participants and observers. “India’s environment is much better and stable than other emerging market economies. If you only consider the interest rate differential, the rupee should depreciate but continued capital flows will offset that,” said N S Venkatesh, executive director, IDBI Bank.

First Rand Bank’s head of treasury, Harihar Krishnamurthy, said much of the weakness in the rupee had been already discounted.

“Our trade deficit numbers are soft, oil prices continue to be benign, inflation is under control. So far, sentiment was driving the market rather than fundamentals. Purely sentiment-wise everyone expects rupee to weaken but we continue to be in a nice place,” said Krishnamurthy.

Bank of America Merril Lynch’s chief India economist, Indranil Sengupta, expects the rupee to strengthen to 65 a dollar by March and 66 a dollar by December 2016. The strength will come on the back of a turnaround in corporate earnings and opening of more space for foreigners in the government securities market, he said.

Any occasional bouts of volatility can be ironed out by RBI through intervention, said Canara Bank’s chief economist, Manoranjan Sharma. “There is no reason for alarm,” he said.

However, QuantArt Market Solutions’ managing director, Samir Lodha, said even as India was well placed, the world was not and that would impact the rupee, pushing it to 70 a dollar by December next year.

“Global financial markets, especially credit markets, are significantly leveraged. It is quite likely that 2016-end would see a crisis-kind of situation stemming from the credit market. Credit contagion will spread and affect India significantly,” said Lodha.

)

)