Sticky inflation may slow down pace of dollar buying

Despite narrowing of the CAD, the rupee has failed to appreciate sharply as RBI interventions continued through state-run banks

BS Reporter Mumbai The pace at which the Reserve Bank of India (RBI) is buying dollars to curb appreciation in the rupee may slow down as inflation continues to be sticky. Despite narrowing of the current account deficit (CAD), the rupee has failed to appreciate sharply as RBI interventions continued through state-run banks.

The central bank has been aggressive in buying dollars — it purchased $8.75 billion in March from the spot market — which slowed down the pace of strengthening of the local currency despite heavy foreign fund inflows, particularly in the equity markets.

If inflows continue, some experts see rupee touching 55 to the dollar, in the near term.

On Tuesday, the rupee saw its worst fall in over two months despite CAD shrinking to 0.2 per cent of the gross domestic product (GDP) in the fourth quarter of the previous financial year compared with 3.6 per cent in the same quarter of the financial year ending March 31, 2013.

“Excessive dollar buying by RBI to curtail rupee gains may come at a cost to RBI. Though RBI hasn’t resorted to sterilisation of rupee liquidity that has so far been created, it may become inevitable for RBI to do so given that inflation continues to be sticky and the risks of inflation in an environment where growth is expected to pick-up cannot be ignored,” said Deepali Bhargava of Espirito Santo Securities India in a note to clients. As a result of this, Bhargava expects the rupee to appreciate to 55 on a 12-month horizon. “There are reasons to believe that the rupee will continue to appreciation going into 2015, though more slowly,” she added.

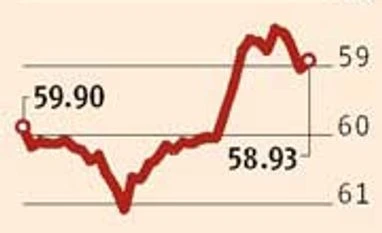

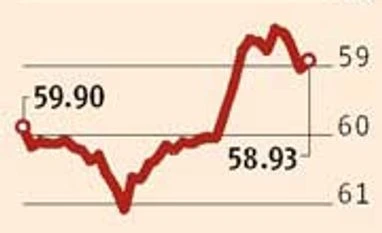

On Wednesday, the rupee ended strong at 58.93 compared with the previous close of 59.04 to the dollar. The rupee had opened at 59.11 and during intra-day trades it touched a high of 58.81 and a low of 59.22 to a dollar.

According to experts, the movement in the rupee will be highly dependent on the Budget to be announced by the new government. “The major trigger for the rupee is the Budget. Besides that, whatever announcements the new government makes from now up to the Budget will also trigger movements in the rupee. If the government takes up reforms in the Budget then inflows will again pick up,” said Mohan Shenoi, president - group treasury and global markets, Kotak Mahindra Bank.

But a few experts believe if inflows continues to be high, the pace of RBI in mopping up dollars may remain the same.

“The pace of RBI's intervention and mopping up (of) dollars will depend upon the amount of flows likely to come in. If inflows increase, then my sense is that they may continue to mop up dollars. Similarly, if inflows decrease then probably RBI may reduce their interventions. RBI will also calibrate their interventions, keeping in mind the total amount of their forward obligations,” said Saugata Bhattacharya, chief economist, Axis Bank.

Latest data show RBI's foreign exchange reserves rose by $ 1.09 billion for the week ending May 16 to $ 314.93 billion. The reserves are consistently rising week after week.

)

)