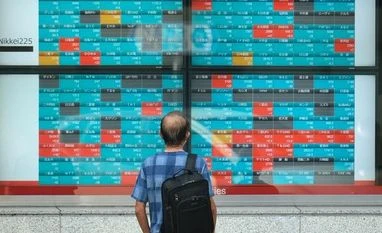

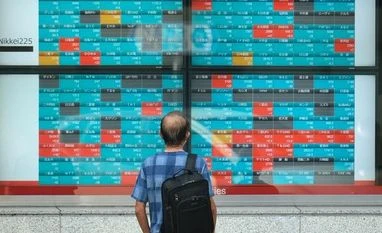

Currencies recover from Omicron chaos; analysts see volatility returning

Currency markets calmed in Asia after the initial shock of Omicron's discovery sent investors scurrying for cover last week

)

Explore Business Standard

Currency markets calmed in Asia after the initial shock of Omicron's discovery sent investors scurrying for cover last week

)

Currency markets calmed on Monday in Asia after the initial shock of Omicron's discovery sent investors scurrying for cover last week, but analysts warned of more volatility with little still known about the new coronavirus strain.

The risk-sensitive Australian dollar rose 0.37% to $0.7139, recovering after a 1% tumble on Friday that saw it dip to $0.71125 for the first time since Aug. 20.

The Mexican peso also rebounded, surging 0.93% to 21.7280 per dollar, after slumping to its weakest in almost 14 months at 22.1540 on Friday.

The safe-harbour yen, which had been the biggest beneficiary of the flight to quality, weakened 0.09% to 113.60 per dollar. The Japanese currency surged as much as 2% at one point on Friday to 113.05.

Fellow haven the Swiss franc sank 0.45% to 0.9257 per dollar.

The South African rand recovered from Friday's one-year low at 16.3675 per dollar, jumping 0.93% to 16.1400.

South Africa discovered the Omicron variant last week, and countries globally have been quick to tighten border controls with mutations in the spike protein suggesting it could be resistant to current vaccines.

Despite the speed of the response, Omicron has since been detected in places including Australia, Britain, Canada, Germany and Hong Kong.

On a reassuring note, a South African doctor who was one of the first to suspect a different coronavirus strain said that symptoms of Omicron were so far "very mild".

BioNTech said Friday it may know within two weeks if the vaccine it developed with Pfizer needs to be reworked.

"Until then, market volatility is likely to remain elevated," Rodrigo Catril, a senior FX strategist at National Australia Bank, wrote in a client note. "Markets have been forced to reassess the global growth outlook until we know more."

"We expect currencies to be volatile this week," echoed Joseph Capurso, a strategist at Commonwealth Bank of Australia. "It will not take much negative news about Omicron to push AUD below $0.7000."

President Joe Biden will give an update later on Monday of the U.S. response to the new variant.

The U.S. dollar index - which measures the currency against six major peers - traded at 96.283, after dipping to a one-week low of 95.973 on Friday.

While the dollar stands to benefit from the uncertainty because of its status as a safe haven, Omicron clouds the outlook for when the Federal Reserve - and other global central banks - can raise interest rates.

The euro, which jumped 0.98% on Friday as traders closed out short positions, dropped 0.32% to $1.12785.

Several officials from the European Central Bank, which has maintained a dovish stance in the face of mounting inflation pressures, have speaking duties on Monday, including ECB president Christine Lagarde.

Sterling was about flat at $1.33325, off Friday's 11-month low at $1.3278.

In cryptocurrencies, bitcoin edged higher to around $57,400, continuing a recovery from Sunday's one and a half-month low of $53,308.93.

(Reporting by Kevin Buckland; Editing by Lincoln Feast.)

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

First Published: Nov 29 2021 | 12:00 PM IST