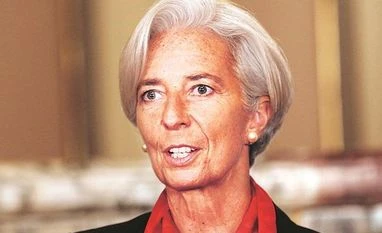

The European Central Bank will focus on more emergency bond purchases and cheap loans for banks when it puts together its new stimulus package next month to help the pandemic-hit euro zone economy, ECB President Christine Lagarde said on Wednesday.

Lagarde said inflation in the 19-country bloc was now likely to remain negative for longer than expected as a second wave of the Covid-19 outbreak forces new restrictions on economic activity.

The ECB’s job was to keep borrowing costs sufficiently low for households, firms and governments and support the banking sector to prevent a credit crunch, she said, pointing to the bank’s Pandemic Emergency Purchase Programme and Targeted Longer-Term Refinancing Operations as its instruments of choice.

“While all options are on the table, the PEPP and TLTROs have proven their effectiveness in the current environment and can be dynamically adjusted to react to how the pandemic evolves,” Lagarde said.

“They are therefore likely to remain the main tools for adjusting our monetary policy.”

Her comments confirmed what sources had told Reuters after the ECB’s Oct. 10 policy meeting and last week.

In a hint the ECB could extend both policies significantly, Lagarde emphasised “the duration of policy support” to ensure all parts of the economy would count on financing conditions remaining “exceptionally favourable”.

The ECB president poured cold water on rising investor optimism about a new vaccine after U.S. drugmaker Pfizer Inc said on Monday its experimental Covid-19 vaccine was more than 90% effective based on initial trial results.

“While the latest news on a vaccine looks encouraging, we could still face recurring cycles of accelerating viral spread and tightening restrictions until widespread immunity is achieved,” she added.

Lagarde was kicking off the ECB’s annual symposium -- held virtually this year due to the pandemic -- at which the world’s top central bankers were due to discuss why monetary policy is not working as it used to and what role they might play in a changed world.

)