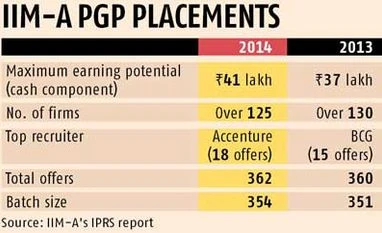

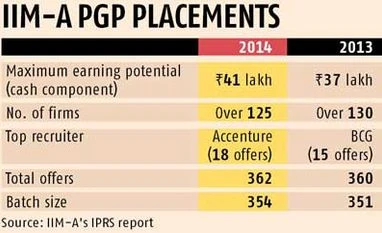

IIM-A placements: Highest global salaries up by 28%, domestic by 10%

BS Reporter Ahmedabad Indian Institute of Management, Ahmedabad (IIM-A) saw the highest international and domestic salaries rise by 28.38 per cent and 10 per cent respectively, data for the final placements of its post-graduate programme in management (PGP) show.

Accenture Strategy emerged as the top recruiter with 18 offers, even as consulting and BFSI (banking, financial services & insurance) led recruitments at IIM-A final placements. The institute released its audited final placements report under the Indian Placement Reporting Standards (IPRS) for 2014. According to the IPRS norms, these reports have been audited by CRISIL, an independent third-party auditor. The highest domestic salary packages that the report projects as 'The Maximum Earning Potential Cash Component' rose by 10.81 per cent to Rs 41 lakh in 2014 from Rs 37 lakh in 2013, based on the 99.2 per cent data points compiled by the institute under the IPRS.

The minimum domestic MEP too increased to Rs 10 lakh from last year's Rs 6.5 lakh. The median MEP too rose to Rs 18 lakh from Rs 16.8 lakh. The highest international MEP stood at $192,581 in 2014, up by 28.38 per cent from last year's $150,000. The minimum and median international MEP rose to $34,323 and $74,562, compared to last year's $26,140 and $46,243, respectively.

According to the institute, data for compensation packages were not available from all recruiters. MEP is the sum of fixed yearly component, total one-time cash benefits and maximum possible performance-linked compensation during first year of performance, and other components of salary that are a part of the offer.

This can include long term compensation such as PF and other perks as well.

More than 125 firms participated in the placement process in 2014, as against more than 130 firms in 2013, including the lateral process. Accenture Strategy emerged as the top recruiter by extending 18 offers to students, thereby replacing last year's top recruiter The Boston Consulting Group (BCG) which made 15 offers to students this year too. The sector saw others like A T Kearney, Bain & Company and McKinsey & Company extending seven offers each, while niche consulting player EXL offered eight roles.

On the other hand, Amazon was the largest recruiter in the technology sector, having extended 15 offers to students for roles in business development and operations. In the said sector, Latent View and Samsung made seven offers to students in data analytics and business development.

Among global investment banks, HSBC was the largest recruiter by picking nine students for roles in investment banking, corporate banking and private banking. In general management firms, RIL was the top recruiter with eight offers.

First time recruiters at IIM-A included the likes of Embibe.com, Fractal Analytics, and Kepler Cannon, amongst others.

With more and more start-ups gaining traction day-by-day, entrepreneurship as career choice saw a whopping rise with 13 students opting out of the placement process to start their own ventures, as against just five last year. The ventures were in areas like IT solutions to support logistics and transportation sector, and platform for improving agriculture supply-chain, amongst others.

While the 2012-14 batch size was 354, total eligible students for final placements was 381. In all, 362 offers were accepted as against 360 last year.

Sectoral trend remained more or less similar to last year at IIM-A's final placements with consulting sector emerging as the lead recruiter at total 118 offers, all domestic, followed by BFSI with total 62 offers, of which 13 were international roles, and FMCG and IT, both extending in all 24 domestic offers.

Meanwhile, 30 companies extended 36 offers in IIM-A's agribusiness management programme (PGP-ABM) with Godrej Agrovet, GSFC, Kirloskar Oil India Limited and Naga Industries being the top recruiters. The programme saw the highest MEP at Rs 20.50 lakh as against Rs 19.73 lakh last year. On the other hand, the institute's post graduate programme for executives (PGPX) saw 52 offers being extended with the highest MEP at Rs 56.31 lakh as against Rs 54.39 lakh last year.

)

)