Shares of Balrampur Chini Mills were up 2 per cent to Rs 164 on Thursday, gaining 6 per cent in the past two trading days on the BSE, on expectation of improved earnings going forward.

The stock is trading close to its 52-week high of Rs 174, touched on September 25, 2019. Besides, it has outpaced the market by surging 15 per cent from its recent low of Rs 142, touched on November 22. In comparison, the S&P BSE Sensex was up 1 per cent during the same period.

In July-September quarter (Q2FY20), Balrampur Chini reported 15 per cent year-on-year (YoY) decline in sales mainly on account of 15 per cent dip in sugar sales impacted by lower monthly sale quote. However, ebitda (earnings before interest, tax, depreciation and amortisation) increased 10 per cent YoY to Rs 155 crore, led by higher sugar realization, lower cost of production and higher margin in the distillery segment. EBITDA margin, too, improved 410 bps YoY to 18 per cent.

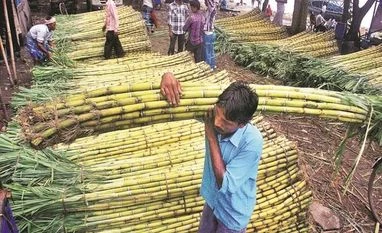

Sugar production is estimated to drop by 20 per cent YoY to 26 million tonne (MT) in sugar season 2019-20 (SS19-20). Production in Uttar Pradesh, which is currently estimated at 12 MT (flat YoY), may also drop as yield could fall due to excessive rains this year, further reducing sugar inventory, according to analysts at Elara Capital.

Analysts at ICICI Securities believe a further reduction in sugar inventories in the next six months would result in robust cash flow from operations.

“The sugar industry is going through a transformation with the introduction of minimum support prices (MSPs) & increasing level of ethanol blending programme. With increasing ethanol volumes, prices and higher export this year, we believe the company would be able to aggressively liquidate its inventory. This, in turn, would result in additional free cash flows and further de-leverage its balance sheet,” the brokerage firm said in result update with ‘buy’ rating on the stock.

)