Banks clock gains but outlook uncertain

Less than satisfactory quarterly results ahead and repo rate rise seen as overhangs

Sneha Padiyath Mumbai Shares of banks rose on Tuesday on hopes that the Reserve Bank of India (RBI)’s move the previous evening to cut short-term borrowing rates by 50 basis points (bps) would ease their liquidity problems in the near term.

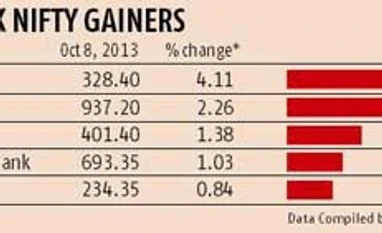

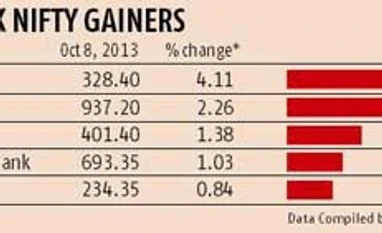

However, the gains were measured as investors sold after early upsides, on worries that the September quarter results would be weak and the central bank might raise the key policy rate in the next review. The NSE Bank Nifty, which opened 3.6 per cent higher on Tuesday, ended with gains of only 0.6 per cent. Private banks performed better than public sector peers. YES Bank rose 3.4 per cent and ICICI Bank gained two per cent. SBI fell two per cent. The broader market indices, the BSE Sensex and the NSE Nifty, gained 0.4 per cent each.

“The strong opening by banking sector stocks was an opportunity for long investors to exit their positions. Most of the positives have already been factored into the stock prices. We are not expecting any fresh buying in the run-up to the result season," said Nirmal Rungta, director and head, private client group, CIMB Securities.

RBI on Monday went a step further in an attempt to dial back on the measures it took in July to curtail the rupee's decline. The central bank cut the Marginal Standing Facility rate by 50 bps to nine per cent, to ease pressure on a liquidity-starved system.

Expectations of weak September quarter earnings numbers was a dampener on stock performance during the day, said analysts. Asset quality and declining margins continue to weigh heavily on these banks and could see these posting poor results.

“RBI normalising the monetary policy could bring relief to some banks but on the whole, the expectation is that the result season is going to be challenging," said Hemant Kanawala, head-equity investments at Kotak Life Insurance.

Analysts say the liquidity push has divided the fortunes of banking stocks. Private sector banks could see some more upside, while public sector bank (PSB) stocks could decline further, going by stock futures positions. Analysts said long positions were being built up in stocks such as YES Bank, IndusInd, Kotak and IDFC, while short positions were being created in the PSB stocks.

“The outlook for private sector banks seems positive and we could see an upside of five to seven per cent in these counters. We are not seeing any aggressive shorts being created in private sector stocks," said Ashish Chaturmohta, head-technical and derivatives analysis at Fortune Equity Brokers.

Some analysts said while concerns remained, further liquidity easing could see some short-covering in stocks.

“The short positions created in banking stocks over the past few sessions have remained intact, signalling that the concerns in the system are not off. SBI and Axis saw fresh shorts during the day. However, if further liquidity easing is seen, we might see some short covering,” said Yogesh Radke, head of quantitative research at Edelweiss Securities.

)

)