Bullish sentiment returns in base metals

Supply shortage, economic stimulus to support prices

)

Explore Business Standard

Supply shortage, economic stimulus to support prices

)

Entire base metals segment is currently trading near their respective many months high on fear of supply constraints. In the last two years, major base metals producers have announced product cuts which has started impacting on supply and ultimately on their prices.

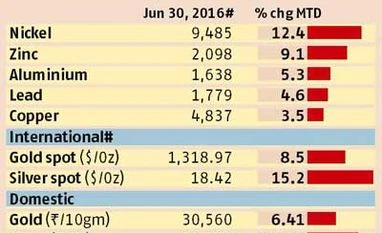

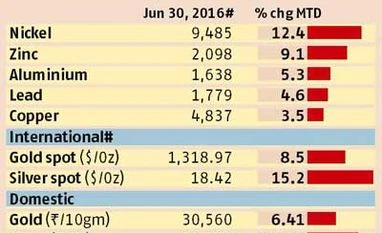

On the benchmark London Metal Exchange (LME), copper price hit 8-week high after traders' fresh bets towards base metals amid expectations of supply deficit. Zinc for three month forward contract hit 12-month high to touch $ 2098 on Thursday following traders' interests in building fresh positions on expectations of further price hike. Aluminium and lead are also trading currently nearly two -month high.

"Trading sentiment remained bullish in base metals due to talks of quantitative easing in the European Union after referendum in favour for Britain's exit (Brexit) from the European Union. Now, entire European Union along with United Kingdom is talking about fresh pumping in money into the system. Since, the next interest rate hike by the United States Federal Reserves (US Fed) looks away from now, the quantitative easing in the European economies would drive base metals," said Jayant Manglik, President (Retail Distribution), Religare Securities Ltd.

Interestingly, copper prices on the LME are currently trading at $4836/tonne on profit booking by traders although China's economy rebounded in the second quarter, with capital expenditures recovering from 5-year lows. A private survey showed on Thursday, as higher government spending helped boost the property and construction sectors. Also, Chinese economic growth indicates positive for base metals.

Meanwhile, dollar softened by a marginal 0.15 paise against the rupee to close on Thursday at 67.52 following the greenback's movement against other global currencies. A softer dollar gives buyers of commodities paying with other currencies stronger purchasing power. The move in base metals was supported by Chinese stimulus measures, helping offset pressure from a wave of new supply.

"We expect copper prices to trade sideways today as slowing Chinese economy remains a cause of concern while weak dollar index will lift the entire commodity complex including copper," said Prathamesh Mallya, Senior Research Analyst (Non-Agro Commodities & Currency), Angel Commodities Broking.

Meanwhile, speculators pushed metals prices through key technical levels, fuelling a rally by triggering pre-set buying orders, also noting industrial metals got a fillip late in the session from a report that OPEC will consider setting a new oil output ceiling at its meeting on Thursday.

Metals were also fuelled by China's manufacturing activity showed signs of steadying in May but remained weak reflecting soft demand at home and abroad, suggesting the world's second-largest economy is still struggling to regain traction. But, economic booster is likely to provide investible surplus at the hands of the common man with a major portion of it to come into base metals, traders said.

First Published: Jun 30 2016 | 10:35 PM IST