Change in ownership at Baroda Pioneer MF

Global merger to introduce Santander, others into the mix

Sachin P Mampatta Mumbai The $172-billion Spanish asset management company, Santander, is set to get a piece of Baroda Pioneer’s mutual fund business. Private equity firms Warburg Pincus and General Atlantic might also have a stake in the mutual fund.

Pioneer investment is set to merge with Santander Asset Management to create an entity, in which private equity firms Warburg Pincus and General Atlantic will also own a stake through their affiliates. The move is set to create a euro 400-billion asset management company, according to a statement on the parent’s global website.

The preliminary agreement involves the creation of a holding company, which will own 66.7 per cent stake of the combination of Pioneer and Santander’s operations outside the US. The holding company will be owned in equal halves by Pioneer’s parent company Unicredit; and the private equity firms. This will give the two entities one-third stake in businesses outside the US. Santander will own the remaining 33.3 per cent.

Pioneer has a 51 per cent stake in the joint venture with Bank of Baroda, according to its last available annual report. This stake is likely to be divided according to the new shareholding pattern. A source said the sponsor for the fund in India is likely to remain the same in spite of the change in shareholding since this is happening at the global level.

“India is a strategic market for Pioneer Investments globally and both Bank of Baroda and Pioneer remain committed to further growing the business,” said a spokesperson in an emailed response. The person declined to comment on specifics of the India impact of the deal.

The asset management company had a loss of Rs 9.78 crore for the financial year ending in March 2014, according to the latest available financials. It had losses of Rs 18.71 crore in the previous financial year.

“The combined firm will continue to operate as one global entity, led by a single global management team, focusing on meeting the needs of its clients worldwide. The agreement is based on an Enterprise Value of euro 2.75 billion for Pioneer Investments and euro 2.60 billion for Santander Asset Management,” said the global statement.

The firm will create presence in Asia along with other markets such as Latin America, and North America, in addition to Europe.

“The partnership between the two firms will provide for substantially enhanced economies of scale, a key advantage in the asset management industry, while also expanding the business’s diversification with respect to investment strategies, distribution channels and region. The combined firm will have robust market share based on deep client relationships in a wide range of markets, including both growing and established regions, covering institutional, wholesale third party, and proprietary channels,” it said.

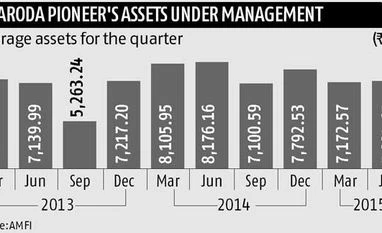

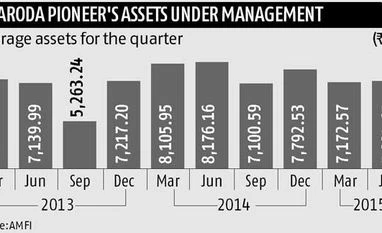

Baroda Pioneer had average assets under management of Rs 7,225 crore for the quarter ended June 2015. This makes it the 22nd largest asset management company in India, according to data from the Association of Mutual Funds in India.

Other asset managers who have foreign stake holding include ICICI Prudential Mutual Fund, Birla Sun Life Mutual Fund and Reliance Mutual Fund.

)

)