Five small stocks that stand to gain from Budget proposals

Despite largely being ignored by market participants, these are worth considering

Jitendra Kumar Gupta As large companies stole headlines after Budget proposals being positive for many, smaller ones went unnoticed. But if markets are right, many of the smaller companies are worth considering as they too have been major beneficiaries of the Budget announcements despite largely being ignored by market participants. Here are a few such companies and why they stand to gain from the proposals.

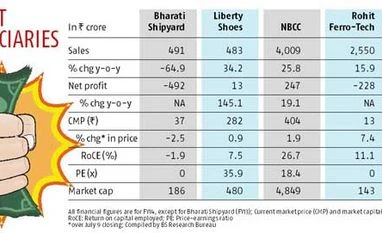

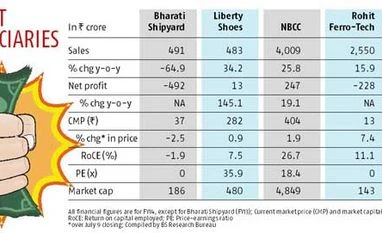

Bharati Shipyard The Budget had greater emphasis on the development of ports and coastal harbours in the country. It also proposed to spend more on ships for the army and coastal guards. The finance minister also said the government will announce a new ship-building policy this financial year, which could have a rub-off on private shipbuilders like Bharati Shipyard, one of the leading companies in the sector involved in the construction of coastal, harbour and inland crafts and vessels. Bharati, which has capabilities in the business, has sought a corporate debt restructuring (CDR) from its lenders as business (revenues) has shrunk in two years. This, with high interest costs (key factor), has led to losses. While there are gains for Bharati, a lot hinges on the CDR approval as well as the quantum of new business it is able to bag.

Liberty Shoes Liberty Shoes, a well-known footwear brand, particularly in urban India, is expected to benefit from the reduction in the excise duty from 12 per cent to six per cent on footwear with retail price between Rs 500 and Rs 1,000 per pair (footwear below Rs 500 per pair remains exempted). This will benefit Liberty, which generates a large chunk of its revenues from high-value footwear - its average realisation per pair is Rs 350-400. Besides, the company has also renewed its business strategy recently and is expanding its retail presence, considered a key trigger for its growth.

NBCC NBCC, which operates under the ministry of urban development, provides management and consultancy services for different types of civil works undertaken by ministries. In the event of high budgetary allocations to ministries, NBCC is poised to gain as that will mean higher orders. The company has an order book of Rs 16,000 crore, four times its FY14 revenues and provides significant visibility. NBCC is also present in the real estate sector, with six projects under execution. It plans to launch 13 real estate projects over two years. Against this backdrop, it is believed that the company could report strong earnings growth. Valuations are also reasonable for a company growing fast.

TCPL Packaging The JSW Group-promoted TCPL Packaging, into packaging material and catering to some like ITC, Hindustan Unilever, Emami, Anchor, Colgate, Godrej, Diageo, United Spirits and Radico Khaitan, will gain from the proposed reduction in the excise duty from 10 per cent to six per cent on the import of packaging machinery. Because of the unavailability of technology in the domestic market, most packaging machines in India are imported. TCPL is a steadily growing packaging company and is India's largest manufacturer of folding cartons, with turnover approaching Rs 400 crore a year. The latter has grown at a compound annual rate of 20 per cent in seven years. Though the debt to equity ratio is high at 1.9 times, growth prospects remain good and valuations reasonable.

Rohit Ferro Rohit Ferro-Tech, a smaller player in the ferro alloy and stainless steel segment, stands to gain from the proposed rise in the custom duty from five per cent to 7.5 per cent. This will encourage demand for domestic products. Because of the lower demand and realisations, companies like Rohit Ferro are making losses. But the proposed duty structure could ease worries of companies like Rohit Ferro, which has a 274,000-tonne capacity to produce ferro alloys used in stainless steel making. Also, it will benefit because of its forward integration, which includes 100,000-tonne stainless steel capacity.

)

)