Intermediate trend appears negative

Devangshu DattaFears of Iraqi turmoil and a poor monsoon could cause bearish pressure. On the other hand, hopes of reforms could have a bullish effect. June settlement day itself is unlikely to see major movements. But there is ample cause for volatility early in the July settlement.

The Iraq situation is obviously not going to be resolved quickly. This means crude prices are likely to see net gains over the next few months, with large dollops of volatility. That is not a good signal for India's external balance of payments. There will be high volatility across energy stocks, where there are also hopes of reforms.

A poor start to the monsoon, with major rainfall deficiency in the first stages also makes inflation on the food front likely.

The rupee is seeing selling pressure as a result. The banking and financials sector, and more broadly, interest rate sensitive businesses, have cause to worry. However, sentiment is strong and there are high hopes for the Budget.

The market has not been able to approach the all-time high of the Nifty 7,700 level. But support between 7,450 and 7,500 has held so far in the correction-consolidation of the past five to six sessions. Moving average enthusiasts will note that the 20 Day Moving Average of the Nifty has been tested and held. There is support at roughly 50-point intervals across the range of 7,100-7,500.

Underlying sentiment is still positive and likely to remain so until the Budget. However, domestic institutions have been net sellers through 2014 and retail investors have taken profits in the past few sessions. Hence, if the foreign institutional investors (FIIs) turn net sellers, there may be a sharp correction.

The rupee's trend reversal could see some hedging into information technology (IT) and pharmaceuticals stocks. The IT sector in particular, is likely to show defensive, counter-cyclical strength if crude continues to move upwards.

A bearspread on the Bank Nifty is also tempting, with a long July 15,000p (350) offset by a short 14,500p (200). This could pay a maximum of 350 versus a cost of 150. Due to the high weight of financials, the broad market movement is not likely to be very positive if the Bank Nifty loses ground.

Sensitive trend following trading systems are giving sell signals. The Nifty/Sensex have dropped below their respective 10 Day Moving Averages and seven DMAs. The short-term trend and intermediate trends appear to be sideways or negative.

The Nifty's put-call ratio is not a strong indicator close to settlement. But it is giving negative readings in the timeframe of June-September and hovering on the edge of negative for June itself. The distribution of open interest chains makes a move of anywhere between 7,000 and 8,000 look possible in the next five sessions.

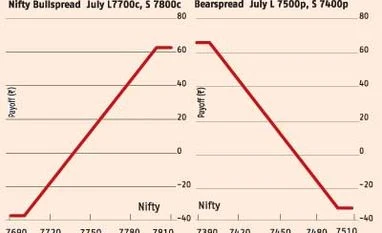

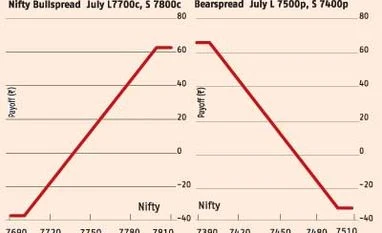

The implied volatility is high for July. The Nifty was held at around 7,570 on Wednesday. A long July 7,700c (122) and short 7,800c (83) costs 39 and pays a maximum 61. A long July 7,500p (117) and a short 7,400c (83) costs 35 and pays a maximum of 65. The bearspread is much closer to the money at 70 points off, than the bullspread (130 points off). This is one sign that the sentiment is still bullish.

Taking strangles doesn't look like profitable given the current risk:reward situation. A brave trader may, in fact, want to sell the short July 7,800c (83) and the short July 7,400p (83) with an intention of buying back on Friday. If the market range-trades through settlement, both options will see dropping premiums.

)

)