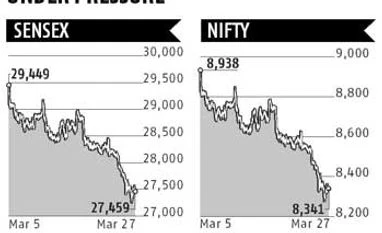

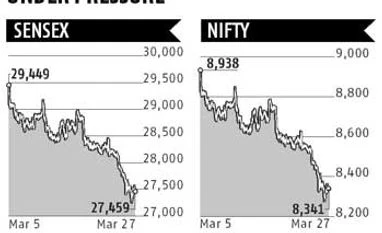

Markets fall third straight week on fears of capital outflows

Emerging geo-political tensions in the Middle-East and prospects of hike in US interest rates dampened sentiment

Tulemino Antao Mumbai Benchmark shares indices ended lower for the third straight week as the emerging geo-political crisis in the West Asia and prospects of a hike in US interest rates raised fears of foreign capital outflows.

In the week to March 27, the 30-share Sensex ended down 802 points or 2.8 per cent at 27,459 and the 50-share Nifty closed 230 points or 2.7 per cent lower at 8,341.

In the broader markets, the BSE Mid-cap Index dropped 265 points or 2.5 per cent to end at 10,360 and the Small-cap Index slipped 419 points or 3.9 per cent at 10,441.

In view of the softening global benchmark prices, the government on Friday announced the first ever reduction in domestic natural gas prices by 9 per cent to $5.01 per million British thermal units (mBtu) and $4.56 on gross calorific value effective from April 1.

All the sectoral indices ended in the negative during the week under review with BSE IT, Bankex, Oil and Gas, Metal and FMCG indices down over 3 per cent each.

Stocks of IT majors were among the top losers after recent data by the US Commerce Department showed that business investment spending in the US declined for the sixth straight month in February. India's IT majors derive most of their revenues from exports to the US. Wipro dropped 6.1 per cent, TCS eased 3.6 per cent, while Infosys ended down 2.5 per cent.

Oil and gas shares also witnessed profit-taking after the government announced the first ever reduction in natural gas prices. Reliance Industries dropped nearly 5 per cent, while state-owned Oil and Natural Gas Corporation closed 2.3 per cent lower.

Telecom shares, which had gained substantially in the past few weeks, witnessed profit-taking after the spectrum auction came to a close on concerns that high cost of spectrum acquisitions could hurt earnings going forward. While Bharti Airtel and Idea Cellular ended down 1-2 per cent each, Reliance Communications slumped 7.5 per cent.

Financials stocks continued their losing streak during the week with the Bank Nifty hitting a three-month low on Thursday. Mortgage lender HDFC ended down 5.7 per cent after the stock was quoted ex-dividend. The board had approved an interim dividend of Rs 2 per equity share of face value of Rs 2 each. In the banking space, SBI, HDFC Bank, Axis Bank and ICICI Bank ended down 1.5-5.3 per cent each.

Tata Power ended down 4.8 per cent. The company in release said it has entered into a Share Purchase Agreement in relation to the 120 Mw Itezhi Tezhi hydropower project in Zambia.

Coal India and engineering major BHEL were among other top Sensex losers down 5.6 per cent and 5.4 per cent, respectively, during the week.

Week ahead

Markets are likely to remain volatile as traders are likely to refrain from taking fresh positions in the truncated week ahead. Further, developments in the West Asia would also weigh on investor sentiment.

Stock exchanges will remain closed on Thursday, April 2 on account of Mahavir Jayanti and on Friday, April 3 on account of Good Friday.

IT stocks might remain subdued after data showed that US GDP slowed down in the fourth quarter. The US Commerce Department said that fourth quarter GDP rose at 2.2 per cent annual rate.

HSBC India Manufacturing Purchasing Managers' Index for March is scheduled for release on April 2, 2015.

Further, the government will release data on the Eight Core Infrastructure Industries and fiscal deficit data for February on March 31, 2015.

)

)