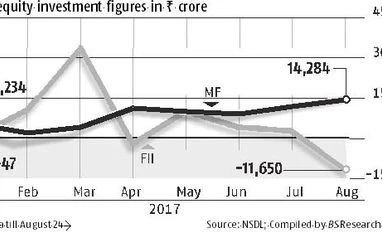

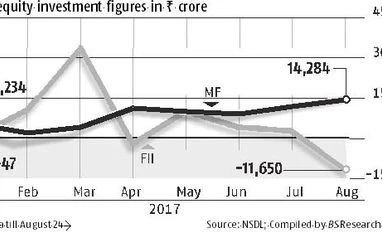

India’s equity fund managers have stepped up buying even as benchmark indices have fallen more than 3 per cent in August. So far this month, equity schemes have bought shares worth nearly Rs 14,000 crore, the highest monthly buying tally for the year.

The benchmark Sensex and the Nifty are down close to 3.5 per cent this month as foreign portfolio investors (FPIs) have pulled out Rs 15,000 crore from stocks. The FPI sell-off was amid global risk aversion created by escalating tensions between the US and North Korea.

Market players say the correction could have been much steeper, if not for MF buying. The surge in MF investments is in line with the strategy of “buying on dips”, said market players. Fund houses are sitting on cash pile of over Rs 40,000 crore, which is used as ammunition to buy stocks during the correction period. “Corrections in market offer opportunities to buy. There are several stocks which also make a good case of value buying at this stage,” says Mahesh Patil, co-chief investment officer (CIO), equities, at Aditya Birla Mutual Fund.

Fund managers have been advising investors not to panic when markets turn steeply volatile. Instead, they suggest investors should use corrections to invest more. And the advice has gone down well with customers. Recent inflows trend clearly suggests that when markets turn weak there is a surge in money flows.

S Naren, CIO, ICICI Prudential Mutual Fund, has long been maintaining a view of the ‘buy on dips’ strategy. He says corrections can always be good buying times if investors have an investment horizon of at least three years.

Some of the large-cap stocks fund managers have been adding this month include Tata Motors, Infosys, HDFC Bank, ICICI Bank, SBI and Sun Pharmaceuticals.

A fund manager said they are actively scouting for good buying opportunities in the mid-cap space and have stocks such as Apollo Tyres, Voltas, Ashok Leyland and India Cements on the ‘buy on dips’ list. The equity segment of mutual funds has been witnessing robust inflows of money. Given the fact that other traditional investment avenues like bank deposits, provident funds, gold and real estate have been losing attraction among investors over the past few years, equity mutual funds have emerged as a clear beneficiary of reducing interest rates and poor yield on gold and realty.

The heightened enthusiasm for equity funds can be gauged from the fact that over the past three years over Rs 2 lakh crore had been pumped by investors — mostly retail. Meanwhile, the amount being poured every month through the systematic investment plan (SIP) route is nearly Rs 5,000 crore — the highest in the sector’s history. Currently, the sector manages nearly Rs 7 lakh crore of equity assets while offering more than 400 schemes.

)

)