MFs to take stance on Nuvo-Grasim merger

Samie ModakDev Chatterjee Mumbai The chief investment officers (CIOs) and fund managers of mutual funds - with exposure in Aditya Birla Nuvo Ltd (ABNL) and Grasim - are meeting in Mumbai to take a joint stand on the mega merger between Nuvo and Grasim.

According to sources in the mutual fund sector, the transaction prima-facie is negative for their unit holders and they would discuss the issue in their forthcoming meeting to be called under the umbrella of Association of Mutual Funds in India. "The meeting is being called so that our unit holders do not face any loss. We have a fiduciary duty towards our respective unit holders and, even if we know that the merger proposal will go through with the help of other minority shareholders, and if in our assessment the deal is not good for our unit holders, then we will certainly oppose it," said the CEO of a large fund asking not to be named.

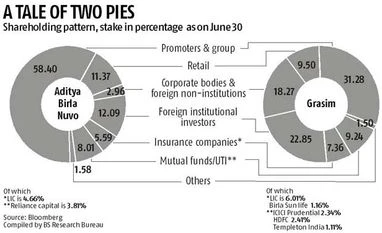

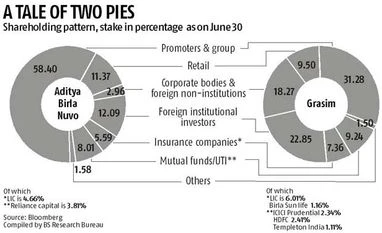

Statistics collated from Bloomberg show that nine mutual funds including Reliance Mutual Fund and UTI Mutual Fund hold eight per cent stake in Nuvo and 9.25 per cent stake in Grasim. The voting for the transaction is still 10-12 weeks away and is crucial because under present laws, a majority of minority shareholders must clear the deal. Minority shareholders currently own 41 per cent in Nuvo and 69 per cent in Grasim.

In December 2015, mutual funds had called a meeting to take a joint stand on Maruti Suzuki's proposal to allow its parent Suzuki to set up a car plant in Gujarat. But, during voting, the funds broke ranks and voted in favour of Maruti.

"A lot will depend on the stand taken by the Life Insurance Corporation of India (LIC) and Aberdeen which hold significant stakes in Nuvo and Grasim," said a top official of a mutual fund.

A source in the Aditya Birla group said it has already made detailed presentations to the mutual funds and to LIC to get them on board. Of the nine funds that hold stake in Nuvo, four have already said they will support the merger, a Birla source said. On August 11, the Aditya Birla group announced the merger of ABNL with Grasim Industries to create an entity with Rs 60,000 crore annual revenue or about $9 billion. The merger was to be followed by the demerger of the financial services business into a separate listed company. But, the investors of Nuvo did not like the merger idea and since the announcement, the Nuvo stock is down 13 per cent. Grasim, after the initial fall, recovered and is up three per cent as on Tuesday. Shareholder advisory firms said on Monday that they would recommend minority shareholders to reject the merger proposal. Shriram Subramanian of Bengaluru-based proxy firm InGovern says the deal is against the interest of small shareholders and the only purpose of the merger is to increase the promoters' stake in the company.

"Investors prefer simple structuring with simple businesses. This transaction is just increasing the layering. For the Grasim shareholders, the layering and holding discount would increase while the Nuvo shareholders will not directly get the benefit of financial services demerger and share it with Grasim shareholders."

)

)